Summary: Central government employees and pensioners are on the cusp of significant salary revisions with the anticipated 8th Pay Commission. Discover how the 8th Pay Commission Salary Calculator can help you estimate your future earnings and plan your finances effectively.

Highlights:

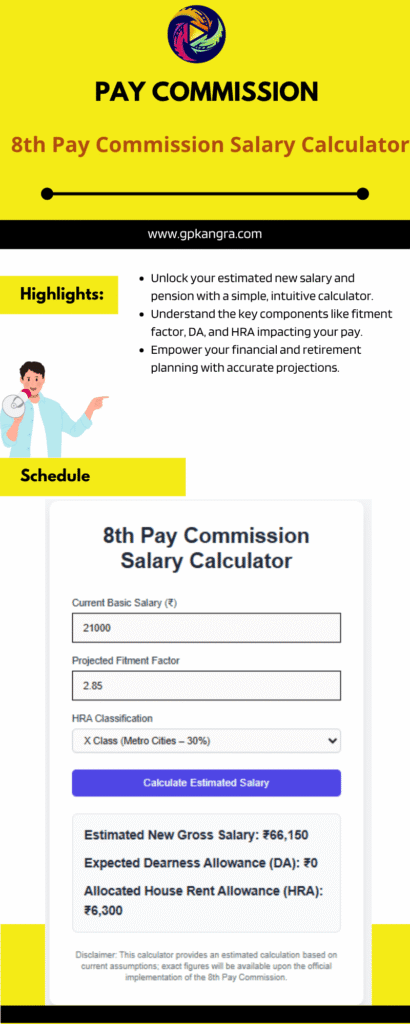

- Unlock your estimated new salary and pension with a simple, intuitive calculator.

- Understand the key components like fitment factor, DA, and HRA impacting your pay.

- Empower your financial and retirement planning with accurate projections.

8th Pay Commission Salary Calculator

8th Pay Commission Salary Calculator: Your Essential Tool for Future Financial Planning

For millions of central government employees and pensioners across India, the anticipation surrounding the 8th Pay Commission is palpable. Implemented typically once every decade, this commission is poised to usher in a new era of salary and pension structures, bringing about a significant increase in their overall financial outlook.

As the official implementation draws closer, understanding the potential impact on your earnings becomes crucial. This is where the 8th Pay Commission Salary Calculator emerges as an indispensable tool, helping you demystify the upcoming changes and prepare for a more secure financial future.

How Does The 8th Pay Commission Salary Calculator Work?

The 8th Pay Commission Salary Calculator, like the efficient Cleartax 8th Pay Commission Calculator, is designed to provide a clear estimation of your revised salary or pension. It meticulously utilizes specific components that are fundamental to government pay structures. These include your current basic salary, the estimated fitment factor, the percentage of dearness allowance (DA), and your HRA classification. By inputting these details, the calculator assesses the possible projected hike in the salaries and pensions of government officials.

While the exact fitment factor is yet to be officially announced, the government has already introduced a 2% hike in the dearness allowance, offering a glimpse into the ongoing adjustments. To calculate your estimated increase, simply follow these straightforward steps:

- Step 1: Enter your current basic salary.

- Step 2: Input your projected fitment factor.

- Step 3: Select the relevant HRA classification (X, Y, or Z).

Based on these inputs, the 8th Pay Commission Salary Calculator will automatically compute your net estimated salary, your expected dearness allowance, and the HRA allocated to you, providing immediate clarity on your potential new income.

Key Components of the 8th Pay Salary Structure

The upcoming 8th Pay Commission will bring about significant changes to the existing salary structure. Understanding these core components is vital for every central government employee and pensioner:

- Fitment Factor and Basic Pay: Under the 8th Pay Commission, the fitment factor, which acts as a multiplier on your basic pay, is widely expected to increase from the current 2.57 to approximately 2.85. This adjustment is projected to lead to a substantial increase in the minimum basic pay for all government employees and pensioners.

- Allowances: The Dearness Allowance (DA), which serves as a cost-of-living adjustment, recently saw a 2% hike. Upon the full implementation of the 8th Pay Commission, the DA is anticipated to merge with the basic pay. Furthermore, House Rent Allowance (HRA) and Travel Allowance (TA) are expected to be recalculated, directly reflecting the new, enhanced basic pay.

- Pension Reforms: For pensioners, the commission is expected to bring about enhanced pension amounts, promising better post-retirement benefits. A key focus will also be on ensuring pension parity and facilitating timely pension disbursement.

- Pay Matrix: A revised pay matrix is likely to be introduced. This new matrix will aim to clarify salary slabs, simplifying subsequent salary progression and increments for all employees.

Example Calculation for 8th Pay Salary Calculator

To illustrate how the 8th Pay Commission Salary Calculator works, let’s consider a practical example:

The revised gross salary under the 8th Pay Commission can be calculated using this formula:

New Gross Salary = (Current Basic Pay x Fitment Factor) + DA + HRA Class

Where:

- Dearness Allowance (DA) = 0 (as per current estimates for this calculation)

- HRA Classification = The percentage of rent and housing allowance provided based on the city of residence.

| HRA Class | City Type | Percentage of Basic Pay |

|---|---|---|

| X Class | Metro Cities | 30% |

| Y Class | Tier 2 Cities | 20% |

| Z Class | Tier 3 Cities | 10% |

Let’s take the example of Mr. Sharma, an employee of the Indian Army residing in New Delhi, who is anticipating a salary increase:

- Basic Pay: ₹1,00,000

- Dearness Allowance (DA): ₹0

- HRA: X Class (Since Delhi is a metro city) = 30% of ₹1,00,000 = ₹30,000

Applying the formula: Gross Salary = (₹1,00,000 x 2.6) + ₹0 + (₹1,00,000 x 30/100) Gross Salary = ₹2,60,000 + ₹0 + ₹30,000 Gross Salary = ₹2,90,000

Hence, Mr. Sharma’s gross estimated salary will amount to ₹2,90,000. This demonstrates the significant impact the commission can have.

Who Can Use the 8th Pay Commission Salary Calculator?

The 8th Pay Commission Salary Calculator is specifically designed for central government employees and pensioners. Its primary purpose is to help them estimate their revised pay benefits based on the expected recommendations of the new commission. It’s a tool for foresight, allowing users to gain a clearer understanding of how changes in crucial factors like the fitment factor, various allowances, and the revised pay matrix could potentially impact their overall compensation. This understanding is key to proactive financial planning ahead of official announcements.

Benefits Of the 8th Pay Commission Salary Calculator

Using the 8th Pay Commission Salary Calculator offers several compelling benefits:

- Quick Salary Estimation: The calculator provides instantaneous estimates of revised salaries and pensions, using a few assumed factors, saving you time and effort.

- Financial Planning: It empowers central government employees and pensioners to plan their finances more effectively by understanding potential income adjustments. This includes budgeting for future expenses or investments.

- Clarity on Allowances & Benefits: The tool offers valuable insights into possible changes in allowances like DA, HRA, and TA, along with the anticipated pension reforms.

- Useful for Retirement Planning: Given that pay commissions are implemented once every 10 years, employees nearing retirement and existing pensioners can use this tool to estimate their revised pension benefits, significantly aiding in better retirement planning.

The 8th Pay Commission Salary Calculator is more than just a tool; it’s a valuable resource for central government employees and pensioners to anticipate their revised earnings and effectively plan their finances for the next decade. By offering quick and precise insights, it helps users prepare for the upcoming salary and pension adjustments with confidence.

Frequently Asked Questions about the 8th Pay Commission Salary Calculator

Here are six common questions about the 8th Pay Commission Salary Calculator:

What is the 8th Pay Commission Salary Calculator use for?

The calculator is designed for central government/ state employees and pensioners to estimate the potential increase in their salaries and pensions based on the expected recommendations of the 8th Pay Commission. It helps in financial planning by providing projected figures.

How often is a Pay Commission implemented?

A Pay Commission is typically implemented once every 10 years, bringing significant changes to the salary and pension structures of central government officials.

What are the key components considered by the calculator?

The calculator primarily uses your current basic salary, an estimated fitment factor, and your HRA (House Rent Allowance) classification (X, Y, or Z class) to assess the projected hike.

What is the “Fitment Factor” and how does it change?

The fitment factor is a multiplier applied to the basic pay. Under the 8th Pay Commission, it is expected to increase from the current 2.57 to approximately 2.85, which will directly impact the new basic pay.

How is Dearness Allowance (DA) treated in the 8th Pay Commission calculation?

As per the current estimates, the Dearness Allowance (DA) is expected to merge with the basic pay upon the implementation of the 8th Pay Commission. Therefore, for calculation purposes in this tool, DA is considered as ₹0.

Is the calculated salary the final and official amount?

No, the calculator provides an estimated calculation based on current assumptions and available information. The exact figures and official implementation details will only be available once the 8th Pay Commission’s recommendations are officially announced and implemented by the government.

Thanks For visiting GPK News