Summary: The recently passed “Big, Beautiful Bill” in the Senate introduces a significant $6,000 tax deduction for seniors aged 65 and older. While not a complete elimination of tax on Social Security, this provision is projected to allow 88% of seniors to pay no tax on social security benefits, greatly expanding the number of those exempt. This could offer substantial social security tax break for many, though its impact on lower-income seniors and the Social Security trust fund warrants closer examination.

Highlights:

- A new $6,000 tax deduction for seniors 65 and older.

- Expected to result in no tax on social security for 88% of eligible seniors.

- The deduction begins to phase out for individual incomes above $75,000 ($150,000 for joint filers).

- Limited benefits for lower-income seniors who already pay little to no tax on social security.

- Could accelerate the insolvency of the Social Security trust fund by approximately one year.

Unpacking “No Tax on Social Security”: How the “$6,000 Senior Deduction” in the “Big, Beautiful Bill” Reshapes Retirement Finances

The landscape of retirement finances is undergoing a significant shift with the recent passage of the Senate’s version of the “Big, Beautiful Bill.” A key provision within this sweeping legislation, a $6,000 tax deduction for Americans aged 65 or older, has garnered considerable attention, particularly for its potential to lead to no tax on social security for a vast majority of seniors.

While the promise of entirely ending taxes on Social Security remains a complex issue, this new measure aims to substantially reduce the social security tax burden for millions.

The $6,000 Senior Deduction: A Closer Look at the “Big Beautiful Bill Social Security” Impact

The “Big, Beautiful Bill,” as dubbed by President Trump, includes a provision designed to provide a considerable social security tax break for older Americans. This $6,000 deduction is a direct response to the long-standing debate around tax on Social Security income and the desire to alleviate financial pressures on retirees.

According to an estimate by President Trump’s Council of Economic Advisers, this change could effectively result in no tax on social security for a remarkable 88% of seniors, a significant increase from the current 64% who are exempt from Social Security taxes. This means approximately 14 million additional seniors could see a direct benefit from this legislative adjustment.

For individuals filing taxes, the deduction offers $6,000 off their taxable income if they earn up to $75,000 annually. For those filing jointly, the income threshold is $150,000. It’s important to note that this deduction is not a universal entitlement; it is structured to phase out for higher earners.

Seniors with individual incomes exceeding $175,000, or joint incomes over $250,000, will find the deduction gradually reduced and eventually phased out altogether. This progressive structure aims to direct the most substantial benefits to middle-income seniors, who often feel the pinch of taxes on Social Security more acutely.

Navigating the Current Landscape of Social Security Tax

To fully appreciate the impact of the new social security tax law, it’s crucial to understand the existing framework. Currently, Social Security benefits are partially taxable. This means that a portion of the benefits received by retirees is subject to federal income tax, and the revenue generated from these social security taxes is channeled back into the Social Security trust fund.

The thresholds for taxation typically involve combined income (Adjusted Gross Income plus tax-exempt interest plus half of your Social Security benefits). For single filers, if this combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxable. If it exceeds $34,000, up to 85% may be taxable. For married couples filing jointly, the thresholds are $32,000 and $44,000, respectively.

The new $6,000 deduction, therefore, directly impacts this calculation by lowering a senior’s overall taxable income, pushing more individuals below the thresholds where Social Security benefits become taxable. This is how the “Big, Beautiful Bill” aims to achieve its goal of creating a scenario where more seniors pay no tax on social security.

Who Benefits Most from This Social Security Tax Break?

While the idea of no tax on social security is universally appealing, the practical benefits of this deduction are not evenly distributed. As Marc Goldwein of the Committee for a Responsible Federal Budget (CRFB) points out, lower-income seniors may experience limited benefits from this new legislation.

The reason is straightforward: many lower-income seniors already pay very little or no tax on social security due to their overall income levels. Their existing standard deduction, which for 2025 is expected to be around $15,000 for individuals and $30,000 for couples, combined with an additional senior-specific deduction ($2,000 for individuals, $3,600 for couples), often already exempts them from federal income tax liability. With the median income for seniors in 2022 being approximately $30,000, many already fall below the taxable income thresholds.

Therefore, the new $6,000 deduction is poised to be more meaningful for upper-middle-class seniors who, under previous tax structures, would have likely paid taxes on a portion of their Social Security benefits.

This demographic will now see a substantial reduction, or even elimination, of their tax on social security income. The “Big Beautiful Bill Social Security Tax” provision is thus a targeted relief, rather than a universal tax cut across all senior income brackets.

The “Big Beautiful Bill Social Security Changes” and the Future of the Trust Fund

One of the critical implications of this new senior deduction, and indeed, of the broader big beautiful bill social security changes, lies in its potential impact on the federal fund that pays out Social Security benefits. The Social Security trust fund has long faced concerns about its long-term solvency, with projections indicating it could face depletion in the coming decade.

The new deduction, by reducing the total taxation of benefits, is estimated to reduce the revenue flowing into the trust fund by approximately $30 billion annually. The CRFB has estimated that this, alongside other changes within the megabill, could accelerate the exhaustion of the Social Security trust fund by about a year, potentially making it insolvent by 2032.

This raises questions about the long-term sustainability of Social Security and whether such tax breaks, while beneficial to individuals, contribute to a larger fiscal challenge.

The Senate version of the bill, currently set to expire after 2028, is estimated to cost $91 billion over four years. In contrast, the House version proposed a $4,000 senior deduction, with an estimated cost of $66 billion over the same period. The difference in these figures highlights the financial implications of such a widespread social security tax break.

Political Tensions and the Path Forward for Social Security Taxes in Big Beautiful Bill

The cost associated with the megabill, including the provisions impacting tax on social security in big beautiful bill, has emerged as a significant point of contention, particularly among fiscal conservatives in the House. Some representatives, such as Andy Harris (R-Md.) and Ralph Norman (R-S.C.), have openly signaled their opposition, arguing that the Senate’s approach has ramped up tax cuts rather than trimming them.

Despite this resistance, the leadership team, backed by President Trump’s insistence on signing the bill into law by Friday, is determined to push it through.

This political dynamic underscores the balancing act between providing tax relief to a key demographic and addressing broader fiscal responsibilities, especially concerning the future of Social Security taxes. The debate surrounding does the big beautiful bill cut taxes on social security in a sustainable way, or merely postpone difficult decisions, continues to unfold.

As seniors ponder will social security be taxed in 2025, the passage of this bill offers a clearer, albeit temporary, answer for many. The new $6,000 deduction means that for a significant portion of older Americans, the concept of no tax on social security big beautiful bill is becoming a tangible reality, even if it’s not a complete overhaul of the social security tax system.

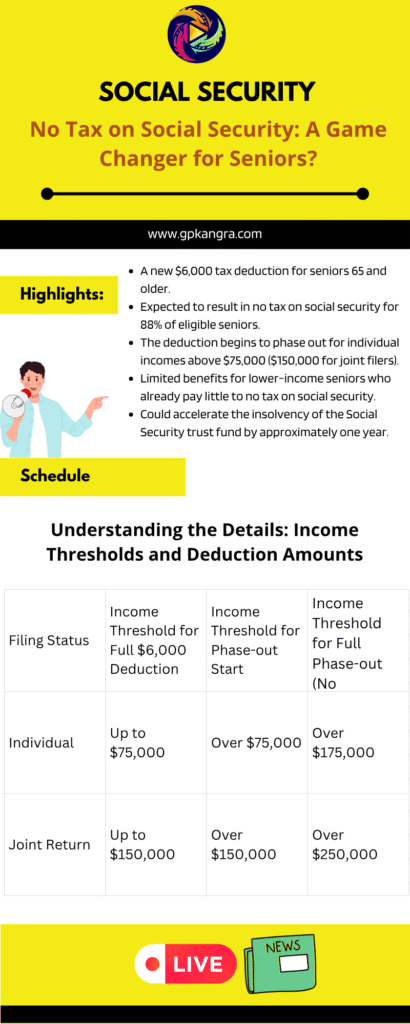

Understanding the Details: Income Thresholds and Deduction Amounts

For a clearer understanding of how the $6,000 senior deduction within the big beautiful bill social security changes will impact various income levels, refer to the table below:

| Filing Status | Income Threshold for Full $6,000 Deduction | Income Threshold for Phase-out Start | Income Threshold for Full Phase-out (No Deduction) |

| Individual | Up to $75,000 | Over $75,000 | Over $175,000 |

| Joint Return | Up to $150,000 | Over $150,000 | Over $250,000 |

Note: These figures are based on the Senate’s version of the bill and are subject to final legislative details.

This table highlights that while the new social security tax law is designed to broadly benefit seniors, those with higher incomes will see a reduced impact, eventually receiving no additional deduction. This emphasizes the targeted nature of the social security tax break provided by the “Big, Beautiful Bill.”

The Road Ahead: What This Means for Retirees and the Economy

The implementation of this $6,000 senior deduction, along with the broader social security big beautiful bill, is a significant development for current and future retirees. For many, it will mean increased disposable income and a welcome reduction in their taxes on social security.

The White House has actively promoted this aspect, emphasizing that the average Social Security beneficiary will effectively pay zero taxes on their benefits due to the combined effect of this new deduction and existing tax provisions.

However, the longer-term implications for the Social Security trust fund remain a concern. While the immediate relief for seniors is clear, the accelerated insolvency projections underscore the need for ongoing dialogue and potential future legislative action to ensure the stability of Social Security for generations to come. The debate around social security taxes in big beautiful bill and their long-term effects is far from over.

Ultimately, the “Big, Beautiful Bill” represents a substantial effort to provide a social security tax break to a large segment of the senior population. As the legislation takes full effect and its impact is measured, it will be crucial to monitor both the direct financial benefits to individuals and the broader economic consequences for the nation’s most vital retirement program.

The question of no tax on social security for the majority of seniors has largely been answered by this bill, at least for the foreseeable future.

FAQs about No Tax on Social Security and the “Big, Beautiful Bill”

Q1: Does the “Big, Beautiful Bill” truly mean no tax on social security for all seniors?

A1: While the “Big, Beautiful Bill” does not completely eliminate tax on Social Security for everyone, it introduces a $6,000 senior deduction that is estimated to result in no tax on social security for 88% of seniors who receive benefits. This significantly increases the number of seniors exempt from social security taxes. However, higher-income seniors may still have a portion of their benefits taxed as the deduction phases out.

Q2: How does the $6,000 senior deduction impact my social security tax burden if I’m a lower-income senior?

A2: For many lower-income seniors, the impact of this new deduction may be limited. This is because they often already pay very little or no tax on social security benefits due to their overall income falling below existing tax thresholds, combined with current standard and senior-specific deductions. The new deduction is more impactful for upper-middle-class seniors who previously paid taxes on social security.

Q3: Will the “big beautiful bill social security” changes affect the long-term solvency of the Social Security trust fund?

A3: Yes, according to estimates from the Committee for a Responsible Federal Budget (CRFB), the new senior deduction, by reducing revenue from social security taxes, could accelerate the insolvency of the Social Security trust fund by approximately one year, potentially leading to insolvency by 2032. This is a significant concern regarding the sustainability of Social Security.

Q4: Is the “no tax on social security big beautiful bill” provision permanent?

A4: No, the Senate’s version of the big beautiful bill social security provision, including the $6,000 senior deduction, is currently set to expire after 2028. This means that while many seniors will experience no tax on social security for the next few years, the long-term tax treatment of benefits could change unless the provision is extended or made permanent through future legislation.

Thanks For visiting GPK News