Summary :As housing affordability continues to challenge Americans nationwide, three major metropolitan areas stand out as beacons of hope: Pittsburgh, St. Louis, and Detroit. These cities offer a unique opportunity for homeownership, with median home prices consistently under $300,000, making them comfortably affordable for households earning between $70,000 and $80,000 annually, adhering to the crucial 30% affordability rule. This affordability, rooted in lower average home prices compared to national trends, provides a vital pathway to homeownership that is increasingly elusive elsewhere.

Highlights

- Pittsburgh, St. Louis, and Detroit are the last affordable housing markets among major US metros, where homes are comfortably within reach for median-income earners.

- Median home prices in these cities were consistently under $300,000 as of May, contrasting sharply with national averages.

- Households earning $70,000 to $80,000 annually can comfortably afford a home, spending 30% or less of their income on housing costs.

- Despite rising prices in the Midwest, these cities maintain affordability due to historically lower home values and a less frenzied building boom compared to other regions.

- The continued affordability is dependent on mortgage rates falling below 4% for more regions to follow suit, highlighting the powerful impact of current high rates.

Pittsburgh, St. Louis, and Detroit: The Last Strongholds of Affordable Housing in America

In an era where soaring home prices and elevated mortgage rates are pushing homeownership out of reach for many Americans, a ray of hope emerges from the heartland and the industrial Northeast. According to recent analyses, just three major US metropolitan areas—Pittsburgh, St. Louis, and Detroit—are holding out as the last affordable housing markets. For households earning between $70,000 and $80,000 annually, a home under $300,000 is not just a dream but a tangible reality in these cities.

The 30% Rule: A Fading Standard, a Midwest Reality

The long-standing benchmark for housing affordability dictates that a household should spend no more than 30% of its income on housing costs, including mortgage, taxes, and insurance. Across much of the United States, this “30% rule” has become an increasingly unattainable ideal. Incomes simply haven’t kept pace with the relentless ascent of home values and interest rates, leading to a drastic shrinking of cities where this financial comfort is possible.

However, Pittsburgh, St. Louis, and Detroit defy this national trend. As of May, the median home in all three cities was listed for under $300,000. This crucial price point means that for a household making the area’s median income, purchasing a home remains comfortably within the 30% affordability threshold.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

A Closer Look at the Affordable Three

Let’s delve into the specifics of what makes these markets so accessible:

- Pittsburgh, Pennsylvania: Often referred to as the Steel City, Pittsburgh leads the pack in affordability for average earners. In May, the median home here was listed at an inviting $250,000. For homebuyers making a 20% down payment, the estimated monthly payment for mortgage, taxes, and insurance at current interest rates would be approximately $1,664. With an average household income of around $73,000, this payment represents a comfortable 27.4% of income, well within the affordability guidelines. Despite not being geographically in the Midwest, Pittsburgh shares similar market dynamics, characterized by its robust healthcare and technology sectors and a stable housing supply.

- St. Louis, Missouri: The Gateway City offers a compelling case for affordability. Realtor Deena Watts, based in Florissant, just north of St. Louis, enthusiastically confirms the city’s value: “It’s a great place to buy property. The cost of living is still worth it in St. Louis. It’s a great place to be.” While acknowledging that a recent $74,900 home sale was an outlier, Watts notes that the average home in the St. Louis area in May was listed just under $300,000. For households earning the area’s median income of about $80,000, this translates to roughly 30% of their income dedicated to housing, perfectly aligning with the affordability standard. Realtor Dawn Griffin highlights close-in suburbs like Affton and Overland, where homes under $250,000 are regularly available, offering significant value.

- Detroit, Michigan: The Motor City continues its resurgence as a beacon of affordability. For average earners in Detroit, purchasing an average home is expected to cost them approximately 29.8% of their income. This figure positions Detroit firmly as one of the most accessible major metropolitan areas for aspiring homeowners. The city’s history and economic shifts have contributed to its lower-than-average home prices, making it an attractive option for those seeking to enter the housing market without facing the exorbitant costs seen on the coasts.

Why These Cities? “Overlooked and Undervalued”

Hannah Jones, a senior economic research analyst at Realtor.com, points to the Midwest as one of the last regions in the country with genuine pockets of affordability. She notes that while these three cities may not boast exceptionally high average wages, their home prices are more than $150,000 below national averages.

“They had really been overlooked and undervalued for a long time,” says Realtor Dawn Griffin, speaking about certain areas within St. Louis. The geographic spread of St. Louis, with its diverse pockets ranging from high-end residences to very affordable homes, contributes to this unique market dynamic.

The Question of Sustainability: Can Affordability Last?

While these cities offer a much-needed reprieve in the current housing climate, the longevity of their affordability remains a key concern. Home prices in much of the country have shown slower growth or even slight declines this year. However, the Midwest has experienced strong price appreciation. This is partly due to the region not seeing the same level of new building activity as parts of the South and Western US, leading to a tighter supply relative to demand.

While the rapid double-digit price jumps seen during the pandemic might be a thing of the past, prices in St. Louis, for instance, are still rising, albeit at a more typical, healthy single-digit pace. This steady appreciation suggests that a significant decrease in prices is unlikely. Other Midwestern metros like Cleveland and Indianapolis have already crossed the 30% affordability threshold, indicating that the window of opportunity might be closing elsewhere in the region.

Realtor.com’s analysis in May noted that mortgage rates averaged around 6.8%. For more metropolitan areas to become broadly affordable for average earners, mortgage rates would need to fall below 4%. As Hannah Jones emphasizes, this situation “underscores the powerful and compounding effect of elevated home prices and high interest rates on housing costs.”

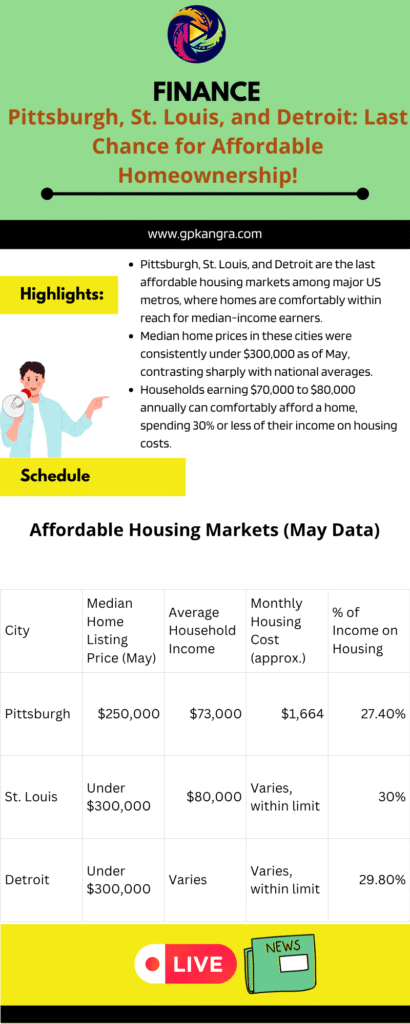

Table: Affordable Housing Markets (May Data)

| City | Median Home Listing Price (May) | Average Household Income | Monthly Housing Cost (approx.) | % of Income on Housing |

| Pittsburgh | $250,000 | $73,000 | $1,664 | 27.4% |

| St. Louis | Under $300,000 | $80,000 | Varies, within limit | 30% |

| Detroit | Under $300,000 | Varies | Varies, within limit | 29.8% |

Note: Monthly housing costs are estimates based on a 20% down payment and May 2024 average interest rates.

Conclusion

For individuals and families feeling priced out of their local housing markets, Pittsburgh, St. Louis, and Detroit offer compelling alternatives. These cities provide a crucial pathway to achieving the dream of homeownership without sacrificing financial stability. While the housing market remains dynamic and complex, their current affordability makes them standout choices for those seeking a tangible opportunity in today’s challenging real estate landscape.

FAQs

1. What makes Pittsburgh, St. Louis, and Detroit the last affordable housing markets in the US?

These cities stand out due to their median home prices consistently being under $300,000 (as of May data), which, when coupled with their median household incomes, allows homebuyers to adhere to the 30% affordability rule, unlike most other major US metros.

2. What is the “30% rule” in housing affordability?

The “30% rule” suggests that a household should spend no more than 30% of its gross income on housing costs, including mortgage payments, property taxes, and home insurance, to be considered comfortably affordable.

3. What are the typical household incomes needed to afford a home in Pittsburgh, St. Louis, and Detroit?

Generally, households earning between $70,000 and $80,000 annually can comfortably afford a median-priced home in these Pittsburgh, St. Louis, and Detroit markets, staying within the recommended 30% affordability guideline.

4. Are home prices in Pittsburgh, St. Louis, and Detroit expected to remain stable?

While home prices in these cities have seen healthy, single-digit appreciation, they haven’t experienced the double-digit jumps seen elsewhere. Experts suggest a significant decrease in prices is unlikely, but sustained affordability depends on factors like future building activity and mortgage rate movements.

5. What should I consider if I’m thinking of moving to Pittsburgh, St. Louis, or Detroit for affordable housing?

Beyond the attractive home prices, consider local job markets, community amenities, and your personal preferences. While Pittsburgh, St. Louis, and Detroit offer significant financial advantages in housing, researching the specific neighborhoods and lifestyle aspects is crucial for a successful relocation.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News