Summary: This article provides a comprehensive guide to the Texas minimum wage 2025 , explaining that Texas follows the federal rate of $7.25/hour. It details important exceptions for tipped employees and young workers, and highlights how certain Texas cities are implementing higher local minimum wages for municipal employees and contractors, despite the state’s adherence to the federal standard.

Highlights:

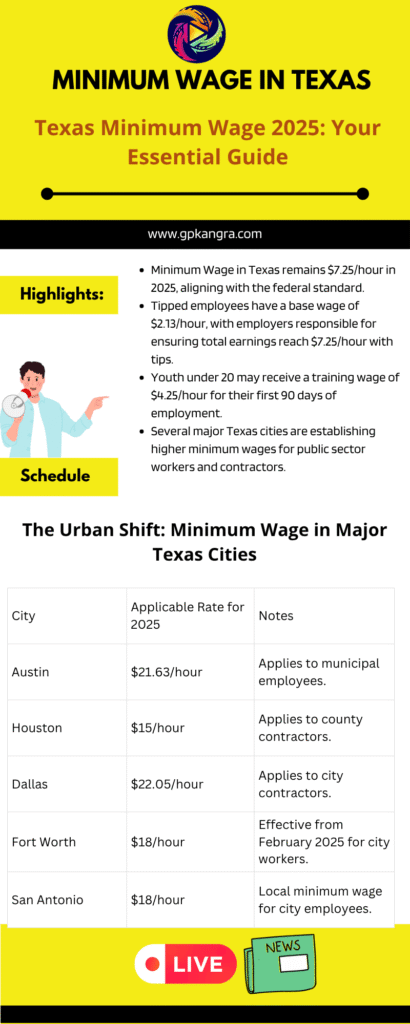

- Minimum Wage in Texas remains $7.25/hour in 2025, aligning with the federal standard.

- Tipped employees have a base wage of $2.13/hour, with employers responsible for ensuring total earnings reach $7.25/hour with tips.

- Youth under 20 may receive a training wage of $4.25/hour for their first 90 days of employment.

- Several major Texas cities are establishing higher minimum wages for public sector workers and contractors.

- Specific categories of workers, including some non-profit employees and family members of employers, are exempt from the standard minimum wage.

What is the minimum wage in Texas? State guide for 2025

For many workers and employers across the Lone Star State, understanding the intricacies of the minimum wage in Texas is crucial. As of 2025, Texas continues to align its minimum wage with the federal rate, which has remained at $7.25 per hour since July 24, 2009.

This makes Texas one of the states with a relatively low minimum wage compared to many others that have implemented higher state-specific rates. This adherence to the federal standard under the Fair Labor Standards Act (FLSA) simplifies the labor regime but can present challenges in meeting the rising cost of living, particularly in Texas’s bustling metropolitan areas.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

However, the landscape of compensation in Texas is not entirely uniform. While the state government maintains the federal benchmark, several progressive cities within Texas have taken steps to implement higher minimum wages for their own municipal employees and contractors. This creates a nuanced scenario where the applicable minimum wage can vary significantly depending on your specific employer and location within the state.

Key Exceptions to the Texas Minimum Wage 2025

It’s important to note that the $7.25/hour minimum wage in Texas does not universally apply to all workers. The FLSA, which Texas follows, outlines several exceptions:

- Tipped Employees: For workers who regularly receive tips, such as those in the hospitality industry, the base cash wage can be as low as $2.13 per hour. However, the employer is legally obligated to ensure that the combination of this base wage and the tips received by the employee amounts to at least $7.25 per hour. If the total falls short, the employer must make up the difference.

- Young People Under 20 (Training Wage): To facilitate entry into the workforce, individuals under 20 years of age may be paid a “training wage” of $4.25 per hour during their first 90 consecutive calendar days of employment. After this probationary period, or upon turning 20, they must be paid the full $7.25/hour minimum wage in Texas. This exception is federally regulated and temporary.

- Workers in Special Programs: Certain individuals, including those with specific disabilities or participating in approved training programs, may be paid a lower wage if their employer holds a special certificate from the Department of Labor. This is designed to support employment opportunities for these groups while ensuring fair compensation relative to their productive capacity.

The Urban Shift: Minimum Wage in Major Texas Cities

While the statewide minimum wage in Texas holds steady, major cities are increasingly stepping up to address the cost of living for their public workforce. These local initiatives demonstrate a growing recognition of the economic realities faced by residents in urban centers. It’s crucial to understand that these higher rates generally apply to municipal employees and contractors, not the broader private sector.

Here’s a snapshot of some major Texas cities and their notable minimum wage rates for 2025:

| City | Applicable Rate for 2025 | Notes |

| Austin | $21.63/hour | Applies to municipal employees. |

| Houston | $15/hour | Applies to county contractors. |

| Dallas | $22.05/hour | Applies to city contractors. |

| Fort Worth | $18/hour | Effective from February 2025 for city workers. |

| San Antonio | $18/hour | Local minimum wage for city employees. |

These figures highlight a significant disparity between the state and local minimums, emphasizing the importance of checking local ordinances if you are a public employee or work with city contracts in these areas.

Beyond the Standard: Additional Exemptions

Beyond the exceptions for tipped and young employees, several other categories of workers are generally exempt from the standard minimum wage in Texas regulations. These include:

- Employees of religious, educational, or non-profit organizations

- Public officials and commission sellers

- Domestic workers

- Employer’s family members

- People in sheltered workshops

- Inmates

- Students in certain programs

- Small agricultural or livestock companies

Breaks and Meals: What Texas Law Says

Another critical aspect of labor law in Texas, often misunderstood, pertains to breaks and meals. Unlike many other states, Texas law does not impose a legal obligation on employers to provide breaks or meal periods to adult employees.

However, if an employer chooses to offer these breaks, they must adhere to the guidelines set forth by the federal Department of Labor (FLSA). This typically means that short breaks (5-20 minutes) must be paid, while bona fide meal periods (usually 30 minutes or more) during which the employee is completely relieved from duty do not have to be compensated.

What to Do If You’re Underpaid

If you believe you are not receiving the legal minimum wage in Texas, it’s crucial to take immediate action. The first step is to gather all relevant documentation, including pay stubs, work schedules, and employment contracts.

You should then consider filing a complaint with the Texas Workforce Commission (TWC). It’s important to act promptly, as there is typically a 180-day deadline from the date the wages were due. Additionally, you may contact the federal Department of Labor’s Wage and Hour Division, especially if your employment falls under FLSA jurisdiction. Consulting with a labor attorney can also provide valuable guidance and legal recourse, particularly in cases of significant unpaid wages or labor abuses.

Understanding the minimum wage in Texas is essential for both employees and employers to ensure fair labor practices and compliance with federal and, increasingly, local regulations.

FAQs about Minimum Wage in Texas

Q1: What is the current minimum wage in Texas for 2025?

A1: The minimum wage in Texas for 2025 remains $7.25 per hour, consistent with the federal minimum wage set by the Fair Labor Standards Act (FLSA).

Q2: Does the minimum wage in Texas apply to all workers?

A2: No, there are several exceptions. Tipped employees, young workers under 20 during their initial training period, and workers in certain special programs or specific industries (like some non-profits or small agricultural companies) may be exempt or have different wage rules.

Q3: Are there any cities in Texas with a higher minimum wage?

A3: Yes, while the state adheres to the federal rate, several major Texas cities like Austin, Houston, Dallas, Fort Worth, and San Antonio have implemented higher minimum wages for their municipal employees and contractors. These rates do not generally apply to the private sector.

Q4: What is the minimum wage for tipped employees in Texas?

A4: For tipped employees, the base cash wage can be $2.13 per hour. However, their total earnings (base wage + tips) must at least reach the federal minimum wage in Texas of $7.25 per hour. If not, the employer must cover the difference.

Q5: What should I do if I’m not paid the minimum wage in Texas?

A5: If you believe you are being paid less than the legal minimum wage in Texas, you should gather your pay stubs and work records, then file a complaint with the Texas Workforce Commission (TWC) within 180 days. You can also contact the federal Department of Labor or consult a labor attorney for further assistance.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News