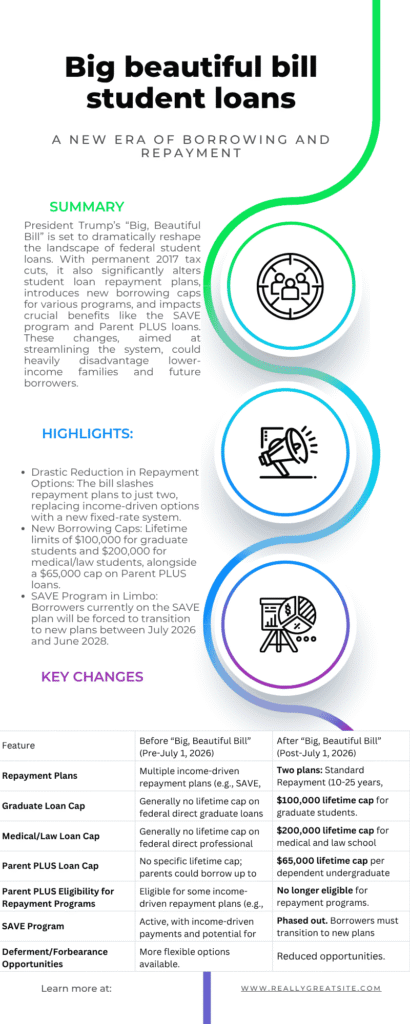

Summary: President Trump’s “Big, Beautiful Bill” is set to dramatically reshape the landscape of federal student loans. With permanent 2017 tax cuts, it also significantly alters student loan repayment plans, introduces new borrowing caps for various programs, and impacts crucial benefits like the SAVE program and Parent PLUS loans. These changes, aimed at streamlining the system, could heavily disadvantage lower-income families and future borrowers.

Highlights:

- Drastic Reduction in Repayment Options: The bill slashes repayment plans to just two, replacing income-driven options with a new fixed-rate system.

- New Borrowing Caps: Lifetime limits of $100,000 for graduate students and $200,000 for medical/law students, alongside a $65,000 cap on Parent PLUS loans.

- SAVE Program in Limbo: Borrowers currently on the SAVE plan will be forced to transition to new plans between July 2026 and June 2028.

- Reduced Deferment & Forbearance: Opportunities for pausing payments become more limited.

- Impact on New Borrowers: The changes are primarily set to affect new federal student loan borrowers starting July 1, 2026.

Big Beautiful Bill Student Loans: A Comprehensive Look at the Upcoming Shake-Up

The federal student loan system is on the cusp of a monumental transformation with the impending signing of President Donald Trump’s “Big, Beautiful Bill.” This sweeping legislation, passed by both chambers of Congress after intense negotiations, goes far beyond tax cuts and business benefits, reaching deep into the pockets and futures of current and prospective students.

For anyone navigating the complex world of student loans, understanding the implications of this “Big, Beautiful Bill” is paramount.

Table: Key Changes to Federal Student Loans under the “Big, Beautiful Bill”

| Feature | Before “Big, Beautiful Bill” (Pre-July 1, 2026) | After “Big, Beautiful Bill” (Post-July 1, 2026) |

| Repayment Plans | Multiple income-driven repayment plans (e.g., SAVE, PAYE, IBR, ICR) and standard/graduated plans. | Two plans: Standard Repayment (10-25 years, fixed) and Repayment Assistance Plan (1-10% discretionary income). |

| Graduate Loan Cap | Generally no lifetime cap on federal direct graduate loans (Grad PLUS). | $100,000 lifetime cap for graduate students. |

| Medical/Law Loan Cap | Generally no lifetime cap on federal direct professional loans (Grad PLUS). | $200,000 lifetime cap for medical and law school students. |

| Parent PLUS Loan Cap | No specific lifetime cap; parents could borrow up to cost of attendance. | $65,000 lifetime cap per dependent undergraduate student. |

| Parent PLUS Eligibility for Repayment Programs | Eligible for some income-driven repayment plans (e.g., Income-Contingent Repayment if consolidated). | No longer eligible for repayment programs. |

| SAVE Program | Active, with income-driven payments and potential for $0 payments for low-income borrowers. | Phased out. Borrowers must transition to new plans between July 2026 – June 2028; automatic enrollment in RAP if no choice made. |

| Deferment/Forbearance Opportunities | More flexible options available. | Reduced opportunities. |

The bill, a sprawling nearly 900-page document, solidifies the 2017 tax cuts while simultaneously rolling back various programs, including former President Joe Biden’s clean energy tax credits and significant benefit programs like Medicaid and the Supplemental Nutrition Assistance Program.

Amidst these widespread changes, the provisions related to student loans stand out for their potential to fundamentally alter how millions of Americans access and repay their education debt.A primary focus of this new legislation, driven by the Trump administration and a Republican-majority House and Senate, is a drastic reduction in the number of available repayment plans.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

This move signals a significant shift away from the more flexible, income-tailored approaches favored in recent years, including the Biden-era SAVE program, towards a more standardized and potentially less forgiving system. This could place a considerable burden on lower-income families, making the pursuit of higher education a more financially daunting prospect.

What Will Student Loans Look Like After the “Big, Beautiful Bill”?

The immediate concern for many federal student borrowers revolves around the practical implications of this bill. If signed into law, new federal student loans will operate under a different set of rules, particularly impacting those seeking graduate and professional degrees, as well as parents assisting their children with tuition costs.

One of the most significant changes is the introduction of concrete borrowing caps across various levels of education. For years, the ability to borrow substantial amounts for advanced degrees allowed many to pursue ambitious career paths, regardless of their immediate financial standing.

The “Big, Beautiful Bill” is set to curb this, potentially pushing some aspiring professionals towards private lenders like Sallie Mae, which often come with higher interest rates and fewer borrower protections.

New Caps on Borrowing: A Tightening of the Purse Strings

The legislation introduces specific lifetime caps on the amount students can borrow for federal student loans:

- Graduate Students: A lifetime cap of $100,000. This could significantly impact master’s and doctoral candidates, forcing them to reconsider program choices or seek alternative funding.

- Medical and Law School Students: A higher, but still substantial, cap of $200,000. Given the typically high cost of these professional degrees, this limit could pose a significant challenge for many.

Furthermore, the bill imposes new limits on lending for part-time students, which could affect those balancing work and education, and reduces opportunities for deferments or forbearance, which provide temporary relief from payments during times of financial hardship. This less flexible approach could lead to increased default rates for vulnerable borrowers.

Student Loan Repayment: A Shift Towards Fixed Rates

Perhaps the most impactful alteration lies within the repayment structure of federal student loans. The “Big, Beautiful Bill” largely dismantles loan forgiveness programs that have been in place for years and fundamentally alters payment requirements that previously aimed to benefit lower-income families.

The system will now consolidate into just two primary repayment plans:

- Standard Repayment Plan: This plan allows borrowers to repay their loans over 10 to 25 years, with payment amounts determined by the total loan amount, irrespective of the borrower’s income. This “one size fits all” approach could prove challenging for those with lower starting salaries or fluctuating incomes.

- Repayment Assistance Plan (RAP): This new plan bases monthly payments on a percentage of the borrower’s discretionary income, ranging from 1% to 10%. While seemingly offering income-based relief, the details of this plan will determine its true impact, especially compared to the more generous terms of previous income-driven repayment options.

The move away from multiple, tailored repayment options to these two streamlined plans signals a more rigid approach to managing student debt. This is a critical point for anyone with existing student loans or those planning to borrow in the future.

How Are Parents Impacted by the Big, Beautiful Bill?

Parents play a crucial role in financing their children’s education, often relying on federal Parent PLUS loans. The “Big, Beautiful Bill” introduces a new cap of $65,000 on these unsubsidized loans, which are offered to parents supporting dependent undergraduate students.

Even more significantly, these Parent PLUS loans will no longer be eligible for the limited repayment programs that remain. This means parents who take on this debt will have fewer options for managing their payments, potentially increasing their financial strain, particularly if their child’s post-graduation income isn’t as high as anticipated.

The Fate of the SAVE Program

The Biden-era SAVE (Saving on a Valuable Education) repayment plan, which has provided relief to around eight million borrowers by tailoring payments to income and even offering $0 monthly payments for some low-income individuals, now faces an uncertain future. While its legality is currently under judicial review, the “Big, Beautiful Bill” explicitly addresses its future.

The bill mandates that current SAVE borrowers find a new repayment plan between July 2026 and the end of June 2028. If a borrower fails to select a new plan by July 1, 2028, they will be automatically enrolled in the new Repayment Assistance Plan based on discretionary income. This transition period could create significant confusion and anxiety for millions of borrowers who have relied on the SAVE program’s more favorable terms.

Who Remains Unaffected by These Changes?

While the scope of the “Big, Beautiful Bill” is vast, it’s important to note that the new changes will primarily impact new federal student loan borrowers taking out loans on or after July 1, 2026. The more than 40 million Americans already carrying existing student loans debt are largely unaffected by these specific alterations to new loan terms and caps. However, borrowers currently enrolled in certain repayment plans, like SAVE, will still need to transition.

The passage of the Big, Beautiful Bill marks a significant turning point for federal student loans. While proponents argue these changes bring fiscal responsibility and accountability to higher education, critics express concerns about increased financial burdens on students and families, potentially limiting access to higher education for those who need it most.

The long-term effects of this legislation on the nation’s student debt crisis and educational landscape will undoubtedly be a subject of ongoing debate and observation. Borrowers, both current and future, are urged to stay informed and understand how these new rules may impact their financial planning and educational pursuits. The era of the student loans senate bill has truly arrived, and its ripple effects will be felt for years to come.

FAQs about the Big Beautiful Bill Student Loans

1. How will the big beautiful bill student loans impact new borrowers?

New federal student loan borrowers, starting July 1, 2026, will face new lifetime borrowing caps for graduate and professional degrees ($100,000 and $200,000 respectively), a $65,000 cap on Parent PLUS loans, and a reduction to just two repayment plan options.

2. What happens to existing student loans under the big beautiful bill student loans?

The new changes primarily impact new federal student loan borrowers. However, existing borrowers currently enrolled in the SAVE program will be required to transition to one of the new repayment plans between July 2026 and June 2028.

3. Will the big beautiful bill student loans eliminate all loan forgiveness programs?

The bill guts many existing loan forgiveness programs and alters payment requirements. While details on specific programs like Public Service Loan Forgiveness (PSLF) need to be carefully reviewed, the overall trend is towards fewer forgiveness opportunities.

4. How does the big beautiful bill student loans affect Parent PLUS loans?

Parent PLUS loans will now have a $65,000 lifetime cap per student and will no longer be eligible for repayment programs, making it harder for parents to manage this debt.

5. What should I do if I’m currently on the SAVE program due to the big beautiful bill student loans?

If you are currently on the SAVE program, you will need to find a new repayment plan between July 2026 and June 2028. If you don’t, you will be automatically enrolled in the new Repayment Assistance Plan after July 1, 2028.

It is advisable to monitor official communications and consult with your loan servicer as these deadlines approach. While companies like Sallie Mae primarily deal with private loans, federal loan changes will impact the broader student loan landscape.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News