Summary: Canadians with low and moderate incomes will get much-needed financial respite next week when they get their next Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit payment. The goal of this tax-free quarterly benefit is to lessen the impact of sales taxes on common items and services. It is automatically calculated when you file your tax return. To make sure you get what is rightfully yours, it is essential to comprehend eligibility and the simple procedure.

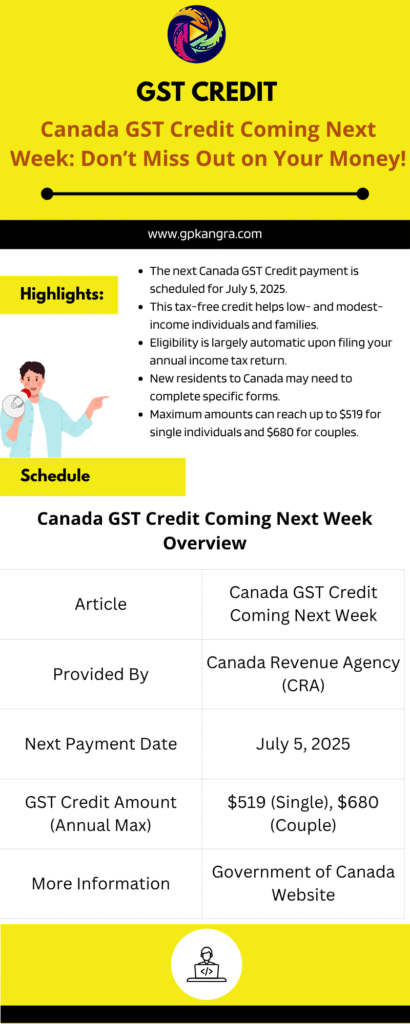

Highlights:

- The next Canada GST Credit payment is scheduled for July 5, 2025.

- This tax-free credit helps low- and modest-income individuals and families.

- Eligibility is largely automatic upon filing your annual income tax return.

- New residents to Canada may need to complete specific forms.

- Maximum amounts can reach up to $519 for single individuals and $680 for couples.

Canada GST Credit Coming Next Week: Your Comprehensive Guide to Eligibility and Claiming Your Benefit

Many Canadians with low and modest incomes are looking forward to the upcoming Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit round as the calendar turns to July. Beneficiaries are busily organizing their spending in anticipation of the Canada GST Credit announcement next week, seeing this program as an essential source of assistance in handling financial difficulties.

The Canada Revenue Agency (CRA) is in charge of this tax-free quarterly payment, which is intended to lessen the financial strain caused by the sales taxes paid on goods and services nationwide.

For individuals and families striving to make ends meet, the GST/HST credit provides a welcome boost. Unlike many other benefits that require complex applications, the beauty of this program lies in its simplicity: for most Canadians, eligibility is automatically assessed when you file your annual income tax return. This means no separate application is typically needed, streamlining the process and ensuring that those who qualify receive their payments without unnecessary hurdles.

If you are interested in knowing more about GST credit 2025, then you must consider reading our page till the end; here you will know about its eligibility, amount, and claiming process.

What is the Canada GST Credit Coming Next Week?

The GST/HST credit is a non-taxable, quarterly payment designed to help low and modest-income Canadians offset the GST or HST they pay on everyday purchases. It’s a fundamental part of Canada’s social safety net, recognizing that sales taxes disproportionately affect those with lower incomes.

This credit is not something you “apply for” in the traditional sense, in most cases. When you file your income tax return, even if you have no income to declare, the Canada Revenue Agency (CRA) automatically assesses your eligibility for this program.

If you meet the criteria, the tax-free payments you receive via this CRA program are immediately assessed, meaning you are exempt from reporting the income you receive on your T1 General income tax form on a quarterly basis. This makes the Canada GST Credit Coming Next Week a truly beneficial and straightforward support system.

Your marital status, whether you have children, and your net family income all significantly impact how much your HST credit will be. For the current payment period, single Canadians may receive up to $519 annually, while those who are married or have a common-law partner could receive up to $680. An additional $179 can be received for each child under the age of 19, providing further assistance to families.

Canada GST Credit Coming Next Week Overview

Here’s a quick look at the essential details regarding the upcoming payment:

| Article | Canada GST Credit Coming Next Week |

| Provided By | Canada Revenue Agency (CRA) |

| Next Payment Date | July 5, 2025 |

| GST Credit Amount (Annual Max) | $519 (Single), $680 (Couple) |

| More Information | Government of Canada Website |

Who Can Claim the Canada GST Credit Coming Next Week?

To be eligible for the GST/HST credit, you must meet specific criteria related to your residency and personal circumstances. The program is specifically designed to provide assistance for Canadians with low-to-moderate incomes.

Generally, you must have been a resident of Canada for income tax purposes both before and at the beginning of the month in which the CRA makes a payment. This ensures that the credit reaches those who are living and contributing within the Canadian tax system.

Additionally, you must fulfill one of the following requirements:

- You’re at least nineteen years old.

- You have a common-law partner or spouse, or you have had one.

- You now reside with your child and were a parent.

Income thresholds are also a crucial factor in determining eligibility. The credit is designed to assist Canadians with low-to-moderate incomes. For single individuals, those who earn $52,255 or more (before taxes) are generally not eligible for the credit.

The maximum yearly net income for a married couple with four kids is $69,015. It’s important to note that these income thresholds are subject to change and are adjusted annually by the CRA. For the most up-to-date information regarding income levels, it is always best to refer to the official website of the Government of Canada. This ensures you have the precise details on who can truly claim the Canada GST Credit Coming Next Week.

How to Do It: Claiming Your Canada GST Credit Coming Next Week

One of the most appealing aspects of the GST/HST credit is the streamlined claiming process for most long-term residents. For the vast majority of Canadians, the HST credit will be automatically applied to you if you are a resident of Canada and file an annual tax return, even if you have no income to declare.

The act of filing your income tax return is what triggers the CRA’s assessment of your eligibility. This means that simply by fulfilling your annual tax obligations, you are taking the necessary step to claim this benefit.

However, for those who are new to Canada, the process is slightly different. A local tax center will want you to fill out a form if you are a newcomer to Canada. The specific paperwork that is needed depends on whether or not you are a parent:

- If you are a parent: You will need to complete Form RC66, also known as the Canada Child Benefits Application. This form allows you to apply for various child and family benefits, including the GST/HST credit. When completing this form, you will need to provide details about your child, such as their name, gender, date, and place of birth, in addition to verifying your citizenship, contact details, and marital status.

- If you are childless: You will require Form RC151, the GST/HST Credit Application for Individuals Who Become Residents of Canada. This form is specifically designed for new residents without children to apply for the GST/HST credit.

You may also be able to accomplish this through your CRA My Account. By choosing “apply for child benefits” in CRA’s My Account, new residents with children can navigate the application process online, submitting the required information digitally.

It is crucial to keep your personal information with the CRA up-to-date, including your address, marital status, and number of children. Any changes in these areas can impact your eligibility and the amount of credit you receive. Promptly updating this information will help ensure you continue to receive your payments accurately and on time, especially with the Canada GST Credit Coming Next Week.

Maximizing Your Canada GST Credit

While the GST/HST credit is largely automatic, there are a few things to keep in mind to ensure you maximize your benefit:

- File Your Taxes Annually: Even if your income is very low or non-existent, filing your income tax return every year is paramount. This is the primary way the CRA determines your eligibility for the GST/HST credit and other benefits.

- Report All Income Accurately: Ensure all your income, including any self-employment income, benefits, or investments, is accurately reported on your tax return.

- Update Your Information Promptly: If your marital status changes (e.g., marriage, common-law union, separation, divorce), or if there are changes in the number of eligible children in your care, inform the CRA immediately. These life events can significantly affect your credit amount and timely updates prevent overpayments or underpayments. You can update your information through your CRA My Account, by phone, or by submitting Form RC65 (for marital status changes).

- Sign Up for Direct Deposit: Receiving your GST/HST credit payments by direct deposit is the quickest and most secure method. This ensures that the Canada GST Credit Coming Next Week arrives directly in your bank account without delays associated with mailed cheques. You can set up direct deposit through your CRA My Account or through your financial institution’s online services.

- Understand Provincial/Territorial Credits: Some provinces and territories also have their own sales tax credits that are delivered alongside the federal GST/HST credit. You usually don’t need to apply separately for these; if you’re eligible for the federal credit, you’ll likely receive the provincial/territorial component as well. Familiarize yourself with the specific credits available in your region.

What if you don’t receive your payment?

If the Canada GST Credit Coming Next Week does not appear in your bank account on July 5th (or shortly thereafter if receiving a cheque), there are a few steps you can take:

- Wait 10 Business Days: The CRA advises waiting at least 10 business days from the payment date before contacting them, as there can sometimes be minor processing delays.

- Check Your CRA My Account: Your My Account is an invaluable tool. You can view your benefit payment dates and status, and confirm if a payment has been issued.

- Ensure Your Information is Up-to-Date: Double-check that your address, marital status, and direct deposit information are current with the CRA. Outdated information can cause delays or misdirection of payments.

- Contact the CRA: If you have waited and confirmed your information is correct, contact the Canada Revenue Agency directly for assistance. Their contact information is available on the Government of Canada website.

Conclusion

The Canada GST Credit Coming Next Week represents a significant and consistent financial aid for low- and modest-income Canadians. By understanding its purpose, eligibility criteria, and the straightforward claiming process (primarily through filing your annual tax return), you can ensure you receive this valuable tax-free benefit. Staying informed and keeping your CRA information updated are key steps to maximizing this support and managing your household finances effectively.

Thanks a ton that you considered staying on our portal to get updates on Canada GST Credit Coming Next Week; we hope you would have found this article informative.

FAQs about Canada GST Credit Coming Next Week:

Q1: When exactly is the Canada GST Credit Coming Next Week?

A1: The next Canada GST Credit payment is scheduled for July 5, 2025. You can typically expect payments to arrive on the 5th of July, October, January, and April.

Q2: Do I need to apply separately to receive the Canada GST Credit Coming Next Week?

A2: For most Canadians, no separate application is needed. The Canada Revenue Agency (CRA) automatically assesses your eligibility for the Canada GST Credit Coming Next Week when you file your annual income tax return, even if you have no income to declare.

Q3: How much can I expect to receive from the Canada GST Credit Coming Next Week?

A3: The amount you receive depends on your marital status, family net income, and the number of children you have. Currently, single individuals can receive up to $519 annually, while married or common-law partners can receive up to $680. There’s an additional $179 for each child under 19.

Q4: What if I am a new resident to Canada and want to claim the Canada GST Credit Coming Next Week?

A4: New residents to Canada will need to fill out specific forms. If you have children, you’ll need Form RC66 (Canada Child Benefits Application). If you are childless, you’ll need Form RC151 (GST/HST Credit Application for Individuals Who Become Residents of Canada). You can also often apply through your CRA My Account.

Thanks For visiting GPK News