Summary: The DWP state pension age change 2026 will raise the pension age from 66 to 67, affecting those born after April 1960. This gradual shift, set to complete by 2028, aligns with rising life expectancy and economic needs.

Highlights:

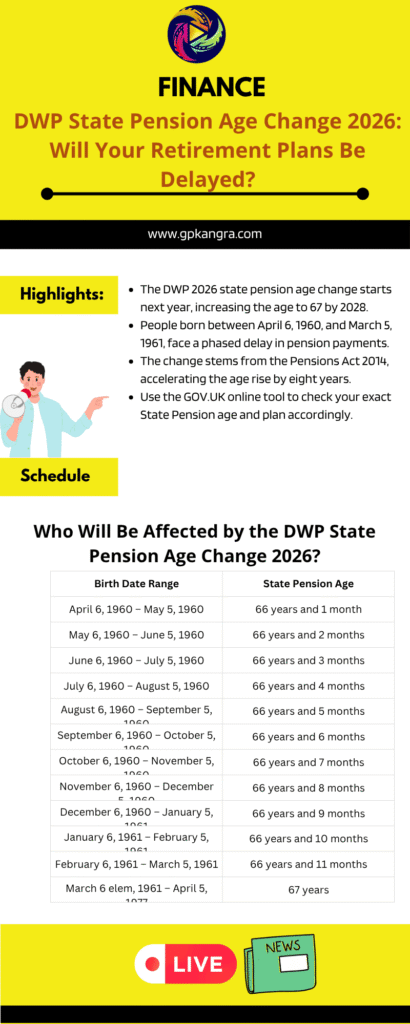

- The DWP 2026 state pension age change starts next year, increasing the age to 67 by 2028.

- People born between April 6, 1960, and March 5, 1961, face a phased delay in pension payments.

- The change stems from the Pensions Act 2014, accelerating the age rise by eight years.

- Use the GOV.UK online tool to check your exact State Pension age and plan accordingly.

DWP State Pension Age Change 2026: What You Need to Know

The DWP state pension age change 2026 is set to impact millions of UK residents planning their retirement. Starting next year, the State Pension age will gradually increase from 66 to 67, a shift that will be fully implemented by 2028.

This change, driven by the Department for Work and Pensions (DWP), is part of a long-term strategy to address rising life expectancy and economic pressures. If you were born after April 1960, this adjustment could delay your pension payments, so understanding the details is crucial for effective retirement planning.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

Why Is the State Pension Age Changing?

The DWP 2026 state pension age change was legislated under the Pensions Act 2014, which accelerated the planned increase from 66 to 67 by eight years. The decision reflects the UK’s aging population and the need to ensure the pension system remains sustainable.

As life expectancy rises, the government aims to balance the costs of providing pensions with the economic realities of a longer-living workforce. This isn’t the first adjustment—between 2018 and 2020, the pension age rose from 65 to 66, and further increases are planned, with the age set to reach 68 for those born after April 1977.

Who Will Be Affected by the DWP State Pension Age Change 2026?

The DWP state pension age change 2026 primarily affects individuals born after April 6, 1960. Those born between April 6, 1960, and March 5, 1961, will experience a phased transition, meaning their pension age will be 66 plus a specific number of months, depending on their birth date.

For example, someone born in May 1960 will reach pension age at 66 years and 2 months, while those born in February 1961 will wait until 66 years and 11 months. Anyone born after March 6, 1961, but before April 5, 1977, will have a State Pension age of 67.

To clarify, here’s the DWP’s timetable for the phased increase:

| Birth Date Range | State Pension Age |

|---|---|

| April 6, 1960 – May 5, 1960 | 66 years and 1 month |

| May 6, 1960 – June 5, 1960 | 66 years and 2 months |

| June 6, 1960 – July 5, 1960 | 66 years and 3 months |

| July 6, 1960 – August 5, 1960 | 66 years and 4 months |

| August 6, 1960 – September 5, 1960 | 66 years and 5 months |

| September 6, 1960 – October 5, 1960 | 66 years and 6 months |

| October 6, 1960 – November 5, 1960 | 66 years and 7 months |

| November 6, 1960 – December 5, 1960 | 66 years and 8 months |

| December 6, 1960 – January 5, 1961 | 66 years and 9 months |

| January 6, 1961 – February 5, 1961 | 66 years and 10 months |

| February 6, 1961 – March 5, 1961 | 66 years and 11 months |

| March 6 elem, 1961 – April 5, 1977 | 67 years |

This phased approach ensures a gradual transition, but it still means delays in pension payments for many. Those born after April 5, 1969, but before April 6, 1977, already had a pension age of 67 under the Pensions Act 2007, so they won’t face additional changes from this reform.

How Will the Change Impact Your Retirement?

For those affected by the DWP 2026 state pension age change, the delay in receiving pension payments could require adjustments to retirement plans. If you were counting on receiving your State Pension at 66, you might need to work a few extra months or rely on savings to bridge the gap. The DWP encourages everyone to check their exact pension age using the online tool at GOV.UK, which provides personalized results based on your date of birth.

The financial implications are significant. A delay of even a few months can affect your income stream, especially if you’re planning to retire early. For example, someone born in December 1960 will wait an additional eight months compared to those born just a few months earlier. This could mean dipping into personal savings or adjusting lifestyle expectations to cover living expenses during the interim period.

Planning Ahead for the DWP State Pension Age Change 2026

To prepare for the DWP state pension age change 2026, consider the following steps:

- Check Your Pension Age: Use the GOV.UK State Pension calculator to confirm your exact pension age. This tool is quick, user-friendly, and provides clarity on when you can expect payments.

- Review Your Finances: Assess your savings, investments, or private pensions to cover any income gaps caused by the delayed State Pension.

- Explore Work Options: If the delay impacts your plans, part-time work or flexible employment could help bridge the financial gap.

- Stay Informed: The government may announce further pension age increases, so keep an eye on official updates from the DWP.

Why This Change Matters

The DWP 2026 state pension age change is more than just a policy tweak—it’s a reflection of broader demographic and economic trends. As people live longer, healthier lives, governments worldwide are rethinking pension systems to ensure they remain viable. However, this shift places a burden on individuals to plan more carefully for retirement. For those nearing pension age, the change could disrupt long-held expectations, making financial preparedness more important than ever.

The DWP emphasizes that this change has been planned since 2014, giving individuals time to adjust. Yet, many may still be unaware of how the phased increase affects them. By staying proactive and using tools like the GOV.UK pension calculator, you can avoid surprises and make informed decisions about your future.

What’s Next for State Pension Age?

Looking beyond 2026, the government has already signaled further increases. Those born after April 5, 1977, will see their State Pension age rise to 68, with potential for even higher ages in the future as life expectancy continues to grow. The DWP state pension age change 2026 is just one step in a long-term strategy to balance pension costs with an aging population.

For now, the focus is on ensuring a smooth transition to age 67. The DWP is urging everyone to verify their pension age and plan accordingly. Whether you’re nearing retirement or planning decades ahead, understanding these changes is key to securing your financial future.

FAQs About DWP State Pension Age Change 2026

What is the DWP state pension age change 2026?

The DWP state pension age change 2026 will increase the State Pension age from 66 to 67, starting in 2026 and completing by 2028, affecting those born after April 1960.

Who is affected by the DWP 2026 state pension age change?

People born between April 6, 1960, and March 5, 1961, will face a phased increase, reaching pension age between 66 years and 1 month to 66 years and 11 months. Those born after March 6, 1961, will have a pension age of 67.

How can I check my State Pension age for the DWP state pension age change 2026?

Use the official State Pension calculator on GOV.UK to find your exact pension age based on your birth date.

Why is the DWP state pension age change 2026 happening?

The change, legislated in 2014, addresses rising life expectancy and economic pressures to ensure the pension system remains sustainable.

Will the DWP 2026 state pension age change affect my pension amount?

The change only affects when you can claim your pension, not the amount. However, delays may require you to rely on other income sources temporarily.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News