For many retirees and individuals with disabilities, their Social Security payment is a lifeline. This article details who will receive their Social Security payment on July 9, 2025, the impact of the 2.5% Cost-of-Living Adjustment (COLA), and what to do if your payment is delayed. Understanding these details ensures you’re prepared for your July benefits.

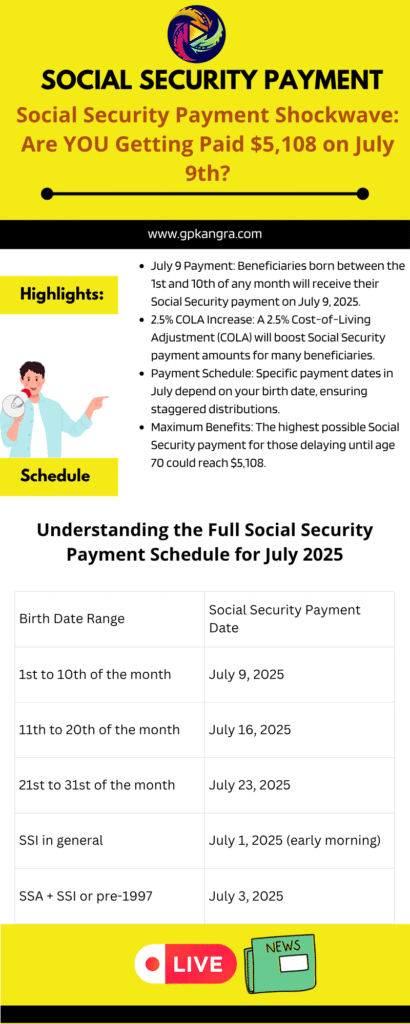

Highlights:

- July 9 Payment: Beneficiaries born between the 1st and 10th of any month will receive their Social Security payment on July 9, 2025.

- 2.5% COLA Increase: A 2.5% Cost-of-Living Adjustment (COLA) will boost Social Security payment amounts for many beneficiaries.

- Payment Schedule: Specific payment dates in July depend on your birth date, ensuring staggered distributions.

- Maximum Benefits: The highest possible Social Security payment for those delaying until age 70 could reach $5,108.

- Troubleshooting Delays: If your Social Security payment is delayed, wait three business days before contacting your bank or the SSA.

Unlocking Your July 2025 Social Security Payment: A Comprehensive Guide

For millions of Americans, the monthly Social Security payment is a cornerstone of their financial stability, especially for retirees and individuals with disabilities. As July 2025 approaches, many beneficiaries are eagerly anticipating their next deposit.

This comprehensive guide will break down everything you need to know about your Social Security payment in July, including who receives payments on specific dates, the exciting impact of the Cost-of-Living Adjustment (COLA), and crucial steps to take if your funds don’t arrive as expected.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

The Social Security Administration (SSA) plays a vital role in ensuring these crucial benefits reach eligible individuals. Understanding the payment schedule and potential adjustments can help beneficiaries manage their finances more effectively. With a 2.5% increase for the cost-of-living adjustment (COLA) for 2025, many will receive amounts above the usual average, providing a welcome boost to their purchasing power.

Understanding the Full Social Security Payment Schedule for July 2025

To help beneficiaries plan their finances, the SSA publishes a clear schedule for Social Security payment distributions. Here’s the complete breakdown for July 2025:

| Birth Date Range | Social Security Payment Date |

| 1st to 10th of the month | July 9, 2025 |

| 11th to 20th of the month | July 16, 2025 |

| 21st to 31st of the month | July 23, 2025 |

| SSI in general | July 1, 2025 (early morning) |

| SSA + SSI or pre-1997 | July 3, 2025 |

This table clearly outlines when you can expect your Social Security payment based on your birth date. For those born late

Who Receives Their Social Security Payment on July 9, 2025?

The SSA meticulously plans its payment distributions to ensure a smooth and efficient process for its vast network of beneficiaries. For the month of July 2025, a specific group of individuals is slated to receive their Social Security payment on Wednesday, July 9.

If you were born between July 1 and 10 (regardless of the year), your monthly retirement or disability payment is scheduled to arrive on July 9, 2025. This applies to both retirees and Social Security Disability Insurance (SSDI) beneficiaries. The SSA follows a system where payment dates are largely determined by the beneficiary’s birth date.

It’s important to note that not all beneficiaries will receive their Social Security payment on this particular date. Other groups, such as those who receive both Social Security and Supplemental Security Income (SSI) or those who started receiving benefits before May 1997, were already paid on July 3, 2025. This staggered system helps the SSA manage the immense volume of payments efficiently.

The Impact of the 2.5% COLA on Your Social Security Payment

One of the most significant updates for Social Security payment beneficiaries in 2025 is the 2.5% Cost-of-Living Adjustment (COLA). This adjustment is designed to help benefits keep pace with inflation, ensuring that the purchasing power of your Social Security payment doesn’t erode over time due to rising costs of goods and services.

This 2.5% increase means that many beneficiaries will see a larger Social Security payment deposited into their accounts. While the average monthly payment for a retired worker is estimated to be around $1,976 in 2025 after the COLA, individual amounts can vary significantly based on several factors, including your earnings history and the age at which you claimed your benefits.

For those who have consistently worked with income at the tax limit for 35 years and strategically waited to claim their benefits, the COLA can lead to substantial monthly payments. For example, if you postponed claiming your Social Security payment until age 70, you could potentially receive up to $5,108 a month. This maximum cap is a testament to the power of delayed claiming and a consistent high earnings record.

Here’s a breakdown of the potential maximum Social Security payment amounts reflecting the 2.5% COLA increase for different retirement ages:

- Early Retirement (age 62): Up to $2,572

- Full Retirement Age (age 67): Up to $4,018

- Postponed until age 70: Up to $5,108 a month

It’s crucial to understand that these are maximum figures, and most individuals will receive an amount closer to the average. Your actual Social Security payment will be calculated based on your own earnings history, specifically your 35 highest-earning years.

r in the month, patience is key, as their payments will arrive in the subsequent weeks of July.

What to Do If You Don’t Receive Your Social Security Payment in July?

While the SSA strives for timely and accurate payments, unforeseen issues can sometimes arise, leading to a delayed Social Security payment. If July 9, 2025, passes and your expected deposit hasn’t appeared, don’t immediately panic. There are a few steps you should take:

- Check your bank account thoroughly: The first and most common reason for a perceived delay is simply a missed notification or a slight processing lag. Verify your bank account balance and transaction history to confirm deposit details. Sometimes, banks may have minor processing delays that result in the payment appearing a day or two later than expected.

- Wait three business days: If you don’t see the Social Security payment on the scheduled date, it’s advisable to wait three full business days. This allows for any potential bank processing delays to clear. Remember that business days typically exclude weekends and federal holidays.

- Contact your bank: If your Social Security payment still doesn’t appear after waiting three business days, your next step should be to contact your bank or financial institution. They can investigate whether the payment was received and held for any reason, or if there were any issues with your account that prevented the deposit.

- Contact the Social Security Administration (SSA): If your bank confirms that they have not received the Social Security payment, then it’s time to reach out to the SSA directly. You can contact them by calling their toll-free number at 1-800-772-1213. When you call, be prepared to provide your Social Security number and any relevant information about your expected payment. The SSA can trace the payment and help resolve any discrepancies.

- Utilize the my Social Security portal: For a proactive approach, consider using the “my Social Security” online portal. This secure online account allows you to review your upcoming Social Security payment dates, check your benefit amounts, and even update your direct deposit information if needed. It’s a valuable tool for managing your benefits and staying informed.

Remember, if you were born between the 1st and 10th, on July 9, 2025, you will receive your Social Security payment, with an average monthly payment of $1,976 and a possible cap of $5,108 if you started late. Don’t forget that if you also receive SSI or started before 1997, your payment was already disbursed on July 3. Prompt action and clear communication with your bank and the SSA are key to resolving any payment issues.

Conclusion

The arrival of your Social Security payment is a significant event each month. By understanding the July 2025 schedule, the positive impact of the 2.5% COLA, and the steps to take in case of a delay, you can ensure a smooth and stress-free experience. The SSA continues to work diligently to provide these vital benefits to millions of Americans, and staying informed is your best strategy for managing your financial well-being.

FAQs about your Social Security Payment in July 2025

Q1: When will I receive my Social Security payment if my birthday is on July 5th?

A1: If you were born between July 1st and 10th, your Social Security payment for July 2025 is scheduled to arrive on July 9, 2025.

Q2: How much can I expect my Social Security payment to be in July 2025 due to the COLA?

A2: Thanks to the 2.5% COLA, the average monthly Social Security payment for a retired worker is estimated to be $1,976. However, your individual amount will depend on your earnings history and the age you claimed benefits, with a maximum possible Social Security payment of $5,108 for those who waited until age 70.

Q3: What if I receive both Social Security and SSI? When will my Social Security payment arrive?

A3: If you receive both Social Security and SSI, or if you started receiving Social Security benefits before May 1997, your Social Security payment was already issued on July 3, 2025.

Q4: My Social Security payment hasn’t arrived on July 9th. What should I do first?

A4: First, check your bank account thoroughly. Then, wait three full business days for any potential bank processing delays. If it still doesn’t appear, contact your bank, and then the SSA at 1-800-772-1213.

Q5: Can I check my upcoming Social Security payment dates online?

A5: Yes, you can access your personal “my Social Security” account on the SSA website to review your upcoming Social Security payment schedule, benefit amounts, and update your personal information.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News