Summary: Over 1.5 million Singaporeans are set to receive significant cash payouts of up to S$850 and MediSave top-ups as part of the Singapore GST Voucher 2025 scheme starting in August. The Ministry of Finance has announced an increased assessable income threshold, expanding eligibility and reinforcing the government’s commitment to supporting lower and middle-income households amidst rising costs.

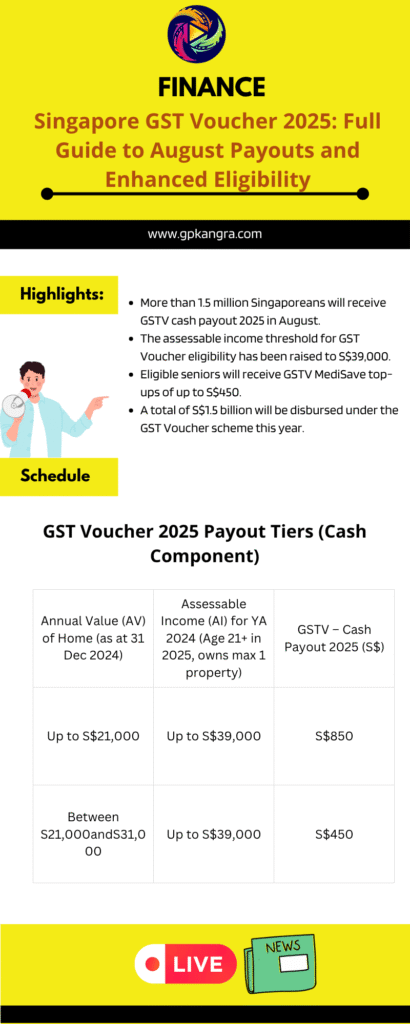

Highlights:

- More than 1.5 million Singaporeans will receive GSTV cash payout 2025 in August.

- The assessable income threshold for GST Voucher eligibility has been raised to S$39,000.

- Eligible seniors will receive GSTV MediSave top-ups of up to S$450.

- A total of S$1.5 billion will be disbursed under the GST Voucher scheme this year.

Singapore GST Voucher 2025: Up to S$850 Cash Payouts & MediSave Top-Ups Coming This August!

Singapore GST Voucher 2025: The highly anticipated Singapore GST Voucher 2025 payouts are just around the corner, bringing substantial financial relief to over 1.5 million eligible Singaporeans. Starting in August, these vital disbursements, encompassing cash payouts and MediSave top-ups, are a cornerstone of the government’s ongoing commitment to support its citizens, particularly lower and middle-income households, in managing the cost of living.

The Ministry of Finance (MOF) has confirmed that a total of S$1.5 billion will be disbursed under the permanent GST Voucher scheme this year, reflecting a continued effort to offset the Goods and Services Tax (GST) expenses.

Enhanced Eligibility for Broader Reach

In a significant update, the assessable income (AI) threshold for GSTV – Cash payouts has been raised. Previously set at S34,000,thenewthresholdforthe Singapore GST Voucher 2025 cash components now S39,000. This adjustment, as stated by MOF, aims to “maintain the coverage of the scheme” given the improvements in the incomes of lower and middle-income Singaporeans.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

This expansion means more households will find themselves eligible for this crucial financial support, ensuring the scheme remains relevant and impactful.

Who is Eligible for the GSTV Cash Payout 2025?

For adult Singaporeans to be eligible for the GSTV cash payout 2025, they must meet specific criteria based on their assessable income and the annual value of their home as of December 31, 2024. The tiered payout structure ensures that those with lower incomes and more modest homes receive higher support.

Here’s a breakdown of the GST Voucher eligibility for the cash component:

- Up to S$850 Payout: Singaporeans aged 21 and above in 2025, with an assessable income of up to S39,000(forYearofAssessment2024),andlivinginhomeswithanannualvalueofuptoS21,000, will receive S$850. They must also not own more than one property.

- Up to S$450 Payout: Those who meet the same age and income criteria but whose homes have an annual value between S21,000andS31,000 will receive S$450. Again, they must not own more than one property.

It’s important to note that Singaporeans owning more than one property are generally not eligible for the cash payout.

Boosting Healthcare Savings with GSTV MediSave Top-Ups

Beyond the cash component, the Singapore GST Voucher 2025 also extends support through MediSave top-ups, specifically designed to help eligible seniors with their healthcare expenses. Approximately 690,000 eligible Singaporean seniors will receive between S150andS450 in MediSave top-ups.

The amount of MediSave top-up varies depending on the senior’s age and the annual value of their home (as of December 31, 2024), provided they do not own more than one property. For instance, seniors aged 85 and above in 2025, residing in homes with an annual value of up to S21,000,willreceivethehighestamountofS450.

Seamless Disbursement Process

For eligible recipients who have previously signed up for government benefits like past years’ GSTV, the process for receiving the Singapore GST Voucher 2025 payouts will be automatic. Payments will commence from August 6 for those with PayNow-NRIC linked bank accounts. Those who opted for GIRO will see their payments credited from August 15, while GovCash recipients can expect theirs from August 22.

Recipients will be notified via SMS from “gov.sg” or a letter when their benefits have been credited. The MOF reminds the public that official notifications will not ask recipients to reply to messages, click on links, or provide personal information. Government officials will also never request money transfers or bank login details over the phone.

If you have not previously signed up for government benefits, you can sign up via the govbenefits website. It’s advisable to link your NRIC to PayNow by July 27, 2025, or update your bank account details by July 28, 2025, to ensure a smooth and timely disbursement.

Beyond Cash and MediSave: The Broader Picture of the GST Voucher Scheme

The GST Voucher scheme is a permanent feature of Singapore’s social support framework, continually adapted to address the evolving needs of its citizens. While the cash payouts and MediSave top-ups are prominent components, the broader Assurance Package and annual budgets often include other forms of support, such as U-Save rebates for utilities and Service and Conservancy Charges (S&CC) rebates for HDB households, aimed at providing holistic relief.

Keep an eye on CNA news and official government channels for comprehensive updates on all aspects of these support measures.

The Singapore GST Voucher 2025 is a testament to the government’s commitment to ensuring that no segment of society is left behind as the economy progresses. By enhancing eligibility and providing timely assistance, it aims to help Singaporeans navigate the current economic landscape with greater confidence.

GST Voucher 2025 Payout Tiers (Cash Component)

| Annual Value (AV) of Home (as at 31 Dec 2024) | Assessable Income (AI) for YA 2024 (Age 21+ in 2025, owns max 1 property) | GSTV – Cash Payout 2025 (S$) |

| Up to S$21,000 | Up to S$39,000 | S$850 |

| Between S21,000andS31,000 | Up to S$39,000 | S$450 |

Singapore GST Voucher 2025 FAQs

1. When will the Singapore GST Voucher 2025 cash payouts be disbursed?

The GSTV cash payout 2025 will begin from August 6, 2025, for those with PayNow-NRIC linked bank accounts. Bank transfers will follow from August 15, and GovCash collections from August 22.

2. What are the main criteria for GST Voucher eligibility in 2025?

To be eligible for the Singapore GST Voucher 2025 cash payout, you must be a Singapore citizen aged 21 and above in 2025, have an assessable income of up to S39,000fortheYearofAssessment2024,andownnomorethanonepropertywithanannualvaluenotexceedingS31,000.

3. How can I check my GST Voucher eligibility for 2025?

You can check your GST Voucher eligibility and payout details by logging in with your Singpass on the official govbenefits website.

4. What is the difference between GSTV Cash and GSTV MediSave?

GSTV Cash is a direct cash payout to help offset GST expenses, while GSTV MediSave is a top-up to eligible seniors’ CPF MediSave accounts to help with healthcare costs. Both are part of the broader GST Voucher scheme.

5. Will there be other forms of support under the GST Voucher scheme besides cash and MediSave in Financial Year 2025?

Yes, the GST Voucher scheme, along with the Assurance Package, typically includes other support measures like U-Save rebates for utility bills and Service and Conservancy Charges (S&CC) rebates for HDB households. Keep an eye on official government announcements and CNA news for more details.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News