Will Social Security Beneficiaries Soon See Their Payments Cut in Half? What You Need to Know

Summary: The Social Security Administration (SSA) is set to begin withholding up to 50% of monthly benefit payments from late July 2025 for individuals previously overpaid. This significant policy shift aims to recoup an estimated $72 billion in improper payments made between 2015 and 2022, primarily affecting recipients of Title II benefits like retirement, survivors, and disability insurance.

Highlights:

- Starting late July 2025, the SSA will recover overpayments by withholding up to 50% of monthly benefits.

- This change primarily impacts Title II beneficiaries (Retirement, Survivors, Disability Insurance).

- Recipients have options to fight the overcharge, request a waiver, or negotiate a lower repayment rate before automatic withholding begins.

- Supplemental Security Income (SSI) recipients will retain the 10% withholding rate.

Will Social Security Beneficiaries Soon See Their Payments Cut in Half? Urgent Action Required as New Policy Takes Effect

For millions of Americans relying on Social Security benefits, a significant and potentially alarming change is on the horizon. Starting in late July 2025, the Social Security Administration (SSA) will implement a new policy that could see monthly benefit payments reduced by as much as 50% for individuals who were previously overpaid. This dramatic shift from the prior 10% withholding rate is set to impact a substantial number of Social Security beneficiaries and underscores the urgent need for awareness and action.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

The move comes as the SSA intensifies its efforts to recover an estimated $72 billion in improper payments distributed between 2015 and 2022. These overpayments, ranging from administrative errors to unreported changes in beneficiaries’ circumstances like income, marital status, disability status, or living arrangements, have accumulated over years, and the agency is now pushing to reclaim these funds more aggressively.

The Scope of the Change: Who Will Be Affected?

The new 50% withholding rate primarily targets individuals receiving Title II benefits. This broad category includes:

- Retirement benefits: For those who have reached their eligible retirement age.

- Survivors benefits: Provided to spouses, children, or parents of a deceased worker.

- Disability insurance (SSDI): For individuals with severe disabilities preventing them from working.

It’s crucial to note that recipients of Supplemental Security Income (SSI), a needs-based program, will continue to have their overpayments recouped at the existing 10% withholding rate. This distinction is vital, as SSI recipients often have extremely limited financial resources, and a higher withholding rate could push them into severe hardship.

Previously, the SSA had a policy of withholding a modest 10% of monthly payments to address overpayments. The increase to 50% reflects a more assertive approach, driven by the substantial amount of money the agency aims to recover. This decision follows considerable criticism of the SSA’s handling of overpayments, including a controversial attempt in 2023 to withhold 100% of benefits, which was met with widespread outrage and subsequently revised to the current 50% rate. Records obtained through the Freedom of Information Act revealed that over 2 million Americans were affected by these overpayment situations in 2023 alone.

Dates and Deadlines: What You Need to Know

The timeline for these changes is critical for beneficiaries to understand:

- April 25, 2025: The SSA began issuing overpayment notices to affected individuals.

- July 25, 2025: This is the last day for beneficiaries to respond to their overpayment notices before the automatic 50% withholding begins.

- From August 2025: If no response is received by the deadline, affected individuals can expect to see reduced payments, with up to half of their monthly benefit being withheld.

This short window for response emphasizes the urgency for beneficiaries to review any correspondence from the SSA and take prompt action.

Why This Matters: The Human Impact of Payment Cuts

The ramifications of a 50% cut in Social Security benefits cannot be overstated, particularly for the almost 69 million Americans who rely on these payments. For many, Social Security is their primary, if not sole, source of income, serving as a critical safeguard against poverty. As Shannon Benton, from the Senior Citizens League, aptly stated, “Any amount of clawback could be catastrophic.”

A substantial reduction in monthly payments could have dire consequences, forcing individuals to make impossible choices between essential needs like food, housing, medication, and utilities. This is especially true for those with low incomes, chronic health issues, or limited alternative financial resources. The pressure to repay significant sums can lead to immense financial strain and emotional distress.

Your Options: How to Fight or Mitigate the Impact

If you receive an overpayment notice from the SSA, it’s not a lost cause. The SSA has outlined several avenues for beneficiaries to address the situation and potentially avoid or reduce the impact of the 50% withholding:

- Fight the Overcharge (Request Reconsideration): If you believe the overpayment amount is incorrect or that you were not overpaid, you can appeal the decision by requesting a reconsideration. This involves asking the SSA to review your case again. It’s crucial to submit this request within 60 days of receiving the overpayment notice.

- Request a Waiver: If you acknowledge the overpayment but believe it was not your fault and that repaying it would cause financial hardship, you can request a waiver. The SSA considers factors like whether you were “at fault” for the overpayment and if repayment would “defeat the purpose” of the Social Security Act (i.e., leave you unable to meet basic living expenses) or be “against equity and good conscience.” There is generally no time limit to file for a waiver, but acting quickly is advisable to prevent automatic deductions.

- Negotiate a Lower Rate (Payment Arrangement): If neither reconsideration nor a waiver is granted, or if you agree you owe the money but cannot afford the 50% deduction, you can negotiate a lower repayment rate. The SSA may be willing to work with you on a more manageable payment plan based on your income and expenses. This can often be done by contacting the SSA directly or by submitting Form SSA-634, Request for Change in Overpayment Recovery Rate.

The SSA encourages beneficiaries to explore these options and has provided mechanisms to do so, including paying back online, asking for waivers, or appealing the decision. The agency emphasizes that these options are available especially if the mix-up was not the beneficiary’s fault or if repayment would pose a significant financial risk.

It is strongly advised for Social Security beneficiaries to act promptly upon receiving any overpayment notice. Ignoring these notices could lead to automatic and substantial reductions in monthly payments, potentially causing severe financial distress. Checking papers thoroughly and contacting the SSA for clarification or to initiate one of the aforementioned actions is paramount.

This policy change serves as a stark reminder of the importance of staying informed about Social Security regulations and diligently reporting any changes in circumstances that could affect your benefits. While the SSA is legally obligated to recover improper payments, the human cost of such aggressive recovery efforts is significant, particularly for vulnerable populations. Understanding your rights and options is the first step in protecting your financial well-being.

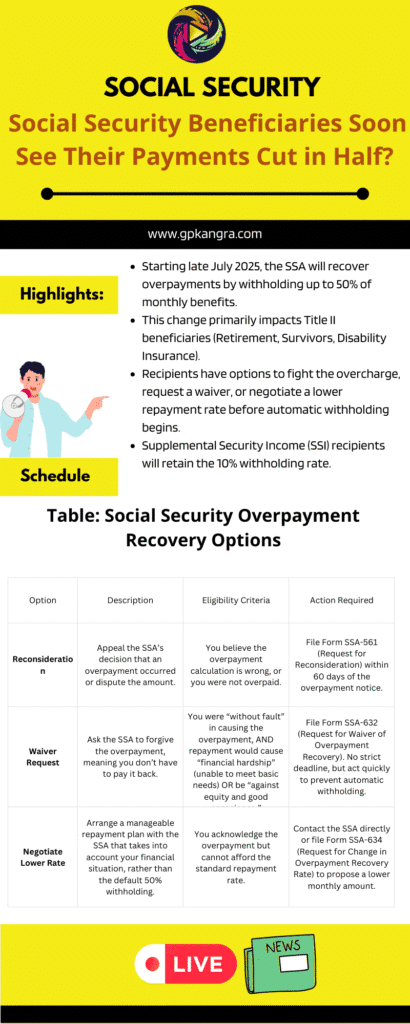

Table: Social Security Overpayment Recovery Options

| Option | Description | Eligibility Criteria | Action Required |

| Reconsideration | Appeal the SSA’s decision that an overpayment occurred or dispute the amount. | You believe the overpayment calculation is wrong, or you were not overpaid. | File Form SSA-561 (Request for Reconsideration) within 60 days of the overpayment notice. |

| Waiver Request | Ask the SSA to forgive the overpayment, meaning you don’t have to pay it back. | You were “without fault” in causing the overpayment, AND repayment would cause “financial hardship” (unable to meet basic needs) OR be “against equity and good conscience.” | File Form SSA-632 (Request for Waiver of Overpayment Recovery). No strict deadline, but act quickly to prevent automatic withholding. |

| Negotiate Lower Rate | Arrange a manageable repayment plan with the SSA that takes into account your financial situation, rather than the default 50% withholding. | You acknowledge the overpayment but cannot afford the standard repayment rate. | Contact the SSA directly or file Form SSA-634 (Request for Change in Overpayment Recovery Rate) to propose a lower monthly amount. |

FAQs about Social Security beneficiaries soon see their payments cut in half?

1. Why are Social Security beneficiaries soon seeing their payments cut in half?

The Social Security Administration (SSA) is implementing a policy to recover billions of dollars in overpayments made between 2015 and 2022. To recoup these funds more quickly, they are increasing the default withholding rate for overpaid individuals from 10% to 50% of their monthly benefits.

2. Which Social Security beneficiaries will be affected by the 50% payment cut?

This policy change primarily affects individuals receiving Title II benefits, including Retirement, Survivors, and Disability Insurance (SSDI). Recipients of Supplemental Security Income (SSI) will continue to have overpayments recovered at a 10% rate.

3. What is the deadline to respond to an overpayment notice before my Social Security payments are cut in half?

The SSA began issuing overpayment notices on April 25, 2025. You generally have until July 25, 2025, to respond and take action (such as requesting reconsideration, a waiver, or negotiating a lower rate) before the automatic 50% withholding begins in August 2025.

4. What can I do if I receive a notice that my Social Security payments will be cut in half due to an overpayment?

You have several options: You can request a “reconsideration” if you believe the overpayment is incorrect, apply for a “waiver” if it wasn’t your fault and repayment would cause hardship, or “negotiate a lower rate” to establish a more affordable repayment plan with the SSA.

5. Will all Social Security beneficiaries soon see their payments cut in half, or only those who were overpaid?

Only Social Security beneficiaries who were previously overpaid by the SSA and have not resolved those overpayments will see their monthly benefits reduced by up to 50%. This change does not affect beneficiaries who have not received overpayments.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News