Optimize Your Retirement: Unveiling the Power of the Social Security Quick Calculator

Navigating Social Security retirement benefits can be complex. This article introduces the Social Security Quick Calculator, a powerful tool designed to help Americans determine their ideal application age for maximizing benefits. We’ll explore its features, delve into the intricacies of Social Security, and provide essential insights for informed retirement planning.

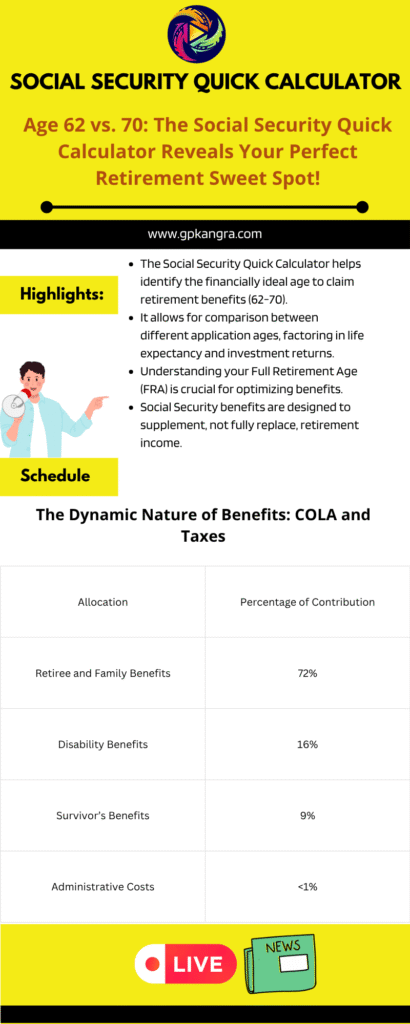

Highlights:

- The Social Security Quick Calculator helps identify the financially ideal age to claim retirement benefits (62-70).

- It allows for comparison between different application ages, factoring in life expectancy and investment returns.

- Understanding your Full Retirement Age (FRA) is crucial for optimizing benefits.

- Social Security benefits are designed to supplement, not fully replace, retirement income.

Optimizing Your Golden Years: A Deep Dive into the Social Security Quick Calculator and Beyond

For millions of Americans, Social Security represents a cornerstone of their retirement planning. Yet, determining the optimal time to claim these crucial benefits can feel like navigating a labyrinth of rules, calculations, and personal circumstances.

While the official U.S. Social Security website offers a range of useful calculators, there’s often a missing piece: a direct, user-friendly tool to pinpoint the financially ideal age (between 62 and 70) to begin receiving retirement payments. This is where the Social Security Quick Calculator steps in, providing a much-needed solution for maximizing your future financial security.

Understanding the Social Security Quick Calculator’s Power

The Social Security Quick Calculator is specifically designed to bridge the gap in existing Social Security planning tools. It empowers individuals to make informed decisions about their retirement benefits by offering two key functionalities:

1. Determine the Ideal Application Age

This feature of the Social Security Quick Calculator helps you identify the age at which you should ideally apply for your benefits to achieve the best financial outcome. It takes into account critical personal factors that directly influence your long-term payout:

- Your Birth Year: This is fundamental as it determines your Full Retirement Age (FRA), which is the benchmark for receiving 100% of your earned benefits.

- Your Life Expectancy: A realistic estimate of how long you expect to live is vital. Claiming early might seem appealing, but if you live a long life, delaying benefits could lead to a significantly higher cumulative payout. The Social Security Quick Calculator helps visualize this trade-off.

- Your Investment Return Per Year: For those with other retirement savings, considering your average investment performance is crucial. The calculator can show how delaying Social Security benefits, while allowing your investments to grow, might impact your overall financial picture.

- Cost of Living Adjustment (COLA) Per Year: Social Security benefits are subject to annual Cost-of-Living Adjustments (COLAs) to counteract inflation. Incorporating an estimated COLA helps project the true future value of your benefits.

By inputting these personalized details, the Social Security Quick Calculator provides an estimated ideal application age, helping you see beyond the immediate appeal of early benefits to the long-term financial implications.

2. Compare Two Application Ages

Life isn’t always about finding the single “ideal.” Sometimes, you need to weigh different scenarios. The Social Security Quick Calculator allows you to compare the financial difference between any two chosen Social Security retirement benefit application ages. This is particularly useful for evaluating:

- Social Security Claim Option 1 (Earlier Retirement Age): Input a chosen early retirement age and the corresponding estimated monthly payment (which you can typically find on the U.S. Social Security website by creating a “my Social Security” account).

- Social Security Claim Option 2 (Work Longer Retirement Age): Enter a later retirement age and its associated estimated monthly payment.

- Other Information: Similar to the ideal age calculation, you’ll input your expected investment return per year and the Cost of Living Adjustment per year.

This comparison functionality allows you to visualize the monetary impact of, for example, claiming benefits at 62 versus waiting until your Full Retirement Age or even until age 70. It provides a clear picture of the trade-offs involved, empowering you to make a decision that aligns with your financial goals and lifestyle.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

The Foundation of Social Security: A Brief History and Key Facts

To truly appreciate the value of the Social Security Quick Calculator, it’s helpful to understand the system it’s designed to optimize. In the U.S., “Social Security” refers to a vital government system providing financial assistance to individuals with inadequate or no income. It’s best understood as “the financial security of society.” While other nations have similar programs, this calculator is specifically for U.S. Social Security.

Before 1935, care for the elderly or disabled was largely a local or state responsibility. This changed with the Social Security Act, signed by President Franklin Roosevelt. Initially, it provided only retirement benefits, but later amendments in 1939 and 1956 added survivor and disability benefits, respectively.

Today, Social Security plays a critical role in preventing poverty among older Americans, serving as a major or even sole source of income for many, despite not being intended as a full income replacement. Lower-wage earners typically receive a higher relative benefit compared to higher-wage earners.

Here are some key facts about Social Security in the U.S.:

- Approximately 169 million Americans contribute through SS taxes.

- Around 65 million Americans, roughly 1 in 5, receive monthly benefits.

- More than three out of five beneficiaries rely on SS for over half their income, and one-third for all of it.

- Administrative costs are remarkably low, at about 1% of total expenditures.

The Dynamic Nature of Benefits: COLA and Taxes

Your Social Security benefits aren’t static. They are influenced by factors like inflation and your overall income.

Cost-of-Living Adjustment (COLA)

Social Security benefits increase annually due to the Cost-of-Living Adjustment (COLA). This adjustment ensures that the purchasing power of benefits keeps pace with inflation. COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the previous year to the third quarter of the current year.

If there’s no increase in the CPI-W, there’s no COLA. For instance, the COLA for 2025 is set at 2.5%. This automatic adjustment is a crucial element for retirees, and something the Social Security Quick Calculator accounts for in its projections.

Social Security Tax

The Social Security program largely operates on a pay-as-you-go system, where current workers’ contributions fund current beneficiaries. The primary source of funding is payroll taxes, often called FICA taxes (Federal Insurance Contributions Act). The Social Security Administration (SSA) levies a 12.4% tax on earnings, typically split evenly between employee and employer. Self-employed individuals pay the full 12.4% as self-employment tax.

It’s important to note that there’s an income cap for Social Security taxes. In 2024, earnings above $168,600 are not subject to Social Security tax. This means that regardless of how much more a person earns, the maximum Social Security tax paid by an employee in 2024 is $10,453.20, and for a self-employed individual, it’s $20,906.40. This cap adjusts annually with inflation. FICA taxes also include Medicare, a federal health program for those aged 65 and older.

Beyond payroll taxes, Social Security also receives revenue from income taxes on benefits paid to higher-income earners and interest earned on reserves invested in U.S. Treasury bonds.

Income Tax on Benefits

Introduced in 1983, the taxation of Social Security benefits depends on your “combined income.” This includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits.

For 2024:

- Single Filers:

- Combined income less than $25,000: No tax on SS benefits.

- Combined income between $25,000 and $34,000: Up to 50% of SS benefits may be taxed.

- Combined income over $34,000: Up to 85% of SS benefits may be taxed.

- Married Filing Jointly:

- Combined income less than $32,000: No tax on SS benefits.

- Combined income between $32,000 and $44,000: Up to 50% of SS benefits may be taxed.

- Combined income over $44,000: Up to 85% of SS benefits may be taxed.

It’s worth noting that qualified Roth IRA withdrawals are not included in your combined income calculation, making them a tax-efficient retirement income source.

Here’s a general breakdown of how FICA taxes are spent:

| Allocation | Percentage of Contribution |

| Retiree and Family Benefits | 72% |

| Disability Benefits | 16% |

| Survivor’s Benefits | 9% |

| Administrative Costs | <1% |

Exemptions from Social Security Tax:

Certain individuals are exempt from paying Social Security tax, including:

- Those who are disabled, deceased, or members of religious groups opposing Social Security benefits.

- Some state and local employees with their own public pension systems.

- Nonresident aliens (e.g., temporary international workers or students).

- Students employed by their enrolled school, where employment is contingent on enrollment.

Social Security for Retirement: Maximizing Your Payout

The amount of your retirement benefit is primarily determined by your lifetime earnings, specifically the average of your 35 highest-earning years. Another critical factor, and where the Social Security Quick Calculator truly shines, is your application age.

Social Security is designed to replace about 40% of the average American worker’s pre-retirement income. It’s crucial to remember that it’s not meant to be your sole source of income in retirement. Diversifying with other retirement savings, like 401(k)s, IRAs, annuities, or rental property income, is highly advisable.

Full Retirement Age (FRA)

Your Full Retirement Age (FRA), also known as normal retirement age, is when you’re entitled to 100% of your Social Security retirement benefits. For those born in 1960 or later, the FRA is 67. For those born between 1943 and 1960, it gradually increases from 66 to 67.

You can claim benefits as early as age 62, but your benefits will be permanently reduced. Conversely, delaying retirement past your FRA, up to age 70, earns you delayed retirement credits, increasing your monthly benefit by a certain percentage each year. After age 70, there’s no further benefit increase from delaying. The Social Security Quick Calculator helps you visualize these critical age-based impacts.

Retirement Benefits While Working

If you’re younger than your FRA and earn above a certain yearly limit, your Social Security benefits will be reduced. For every $2 earned over the annual limit, $1 is withheld from your benefits. However, once you reach your FRA, these reductions cease, regardless of how much you earn.

When to Apply for Social Security Retirement Benefits: A Strategic Decision

Deciding when to apply is a highly personal and strategic decision. While you can apply as early as 61 years and 9 months (benefits start at 62), the SSA only processes applications up to four months before benefits begin. The Social Security Quick Calculator is built to help you consider these factors:

- Immediate Need for Cash: If you’re struggling financially, claiming early might be necessary.

- Life Expectancy: If you anticipate a shorter lifespan, receiving benefits sooner could mean a greater total payout. If you expect to live a long life, delaying for larger monthly payments often makes financial sense.

- Current Earned Income: If you’re still working and earning a substantial income, delaying benefits might be beneficial to avoid reductions and allow your benefits to grow.

- Marital Status: This is particularly relevant for spousal and survivor benefits.

- Relative Age, Income, and Health of Spouse: For married couples, coordinating claiming strategies can significantly impact overall household benefits. A higher-earning spouse might consider delaying to maximize survivor benefits for the other spouse.

Ultimately, individuals with ample savings, good health, and high life expectancies often find it more financially advantageous to delay claiming benefits until later in life, ideally up to age 70. However, the ability to wait isn’t universal, and the Social Security Quick Calculator can help illuminate the best path for your unique situation. It’s also possible to withdraw an application within 12 months of starting benefits, provided all received distributions are repaid, but this option is only available once.

Social Security Credits: The Key to Eligibility

To be eligible for Social Security benefits, you need to earn credits. You can earn a maximum of four credits per year. Most people need 40 credits to qualify for benefits, which typically means 10 years of work.

In 2024, each credit is earned by earning $1,730 in taxable income, so earning $6,920 in a year secures all four credits. This amount is adjusted annually based on the average yearly wage. Once earned, credits cannot be lost.

Certain jobs, like those for some state and local government workers who contribute to their own public pension systems, do not earn Social Security credits.

Receiving Benefits Outside the U.S.

It’s possible for eligible U.S. citizens to receive Social Security benefits while living abroad. Checks can be deposited in a U.S. bank or, in some cases, sent to a foreign country. However, Medicare benefits are generally only available within the U.S. Filing U.S. tax returns (and state tax returns where applicable) remains mandatory. Note that foreign tax laws may impact your benefits.

Beyond Retirement: Social Security for the Disabled

While the Social Security Quick Calculator focuses on retirement benefits, Social Security also provides crucial support for disabled individuals and their dependents. The SSA defines disability as “total disability,” meaning you cannot do work you did before, cannot adjust to other work due to your medical condition, and your disability has lasted or is expected to last at least one year or result in death.

Social Security Disability Insurance (SSDI)

SSDI benefits are for those who have contributed to Social Security through work and earned “work credits.” Medical eligibility is required, and most applications are initially denied. There’s usually a five-month waiting period for the first payment. The number of work credits required varies by age, generally ranging from 6 to 40, with 40 credits typically needed, 20 of which must be earned in the last 10 years before disability onset.

Supplemental Security Income (SSI)

SSI is a separate, needs-based program for those with limited income and resources who may not qualify for SSDI. It does not require work credits and is funded by general taxes, not FICA taxes. SSI recipients often automatically qualify for Medicaid. In some instances, individuals may receive both SSDI and SSI if their SSDI benefit is low enough to meet SSI’s income restrictions.

Social Security for Spouses and Survivors

Social Security also extends to spouses and survivors, offering vital financial protection.

Spousal Benefits

Spousal benefits are available to current or widowed spouses aged 62 or older. A non-working spouse may be eligible for up to half of their working spouse’s benefit, depending on the working spouse’s retirement age. These benefits generally only become available once the primary earner files for their own benefits.

Survivor Benefits

A widow or widower can claim survivor benefits as early as age 60 (or 50 if disabled), provided the marriage lasted at least nine months (waived if a child under 16 is in care). If both spouses were receiving benefits, the surviving spouse can choose to continue receiving their own benefit or the deceased spouse’s, but not both. Strategic claiming, such as filing for one’s own benefit first and then switching to a larger survivor benefit later, is possible.

Divorced Spousal Benefits

Even divorced individuals can claim benefits based on an ex-spouse’s work history, provided they meet specific conditions: unmarried, age 62 or older, the ex-spouse is entitled to SS retirement or disability benefits, and their own benefit is less than what they would receive based on their ex-spouse’s record. This can apply even if the ex-spouse hasn’t filed for their own benefits, as long as both are over 62.

Conclusion: Your Retirement, Optimized with the Social Security Quick Calculator

Retirement planning demands careful consideration, and Social Security is a cornerstone of that plan for most Americans. The Social Security Quick Calculator offers an invaluable resource, allowing you to move beyond guesswork and towards a data-driven strategy for your benefits.

By providing personalized insights into ideal claiming ages and comparing different scenarios, it empowers you to make decisions that could significantly impact your financial well-being in your golden years. Remember, Social Security is a powerful safety net, but understanding how to maximize your benefits, often with the help of tools like the Social Security Quick Calculator, is key to a truly secure and comfortable retirement. Utilize this tool, understand the intricacies of the system, and take control of your financial future.

FAQs focusing on the Social Security Quick Calculator:

Frequently Asked Questions about the Social Security Quick Calculator

1. What is the main purpose of the Social Security Quick Calculator, and how does it differ from other Social Security calculators?

The Social Security Quick Calculator is specifically designed to help U.S. citizens determine the ideal (financially speaking) age, between 62 and 70, to apply for their Social Security retirement benefits.

Unlike some official Social Security Administration (SSA) calculators that primarily provide estimates based on your actual earnings record (often requiring a “my Social Security” account login), the Quick Calculator allows you to input your own birth year, life expectancy, investment return, and cost of living adjustment to quickly compare different claiming ages.

It helps visualize the long-term financial implications of starting benefits at various points, which is a unique focus compared to tools that might just show benefit amounts at 62, FRA, and 70 without considering your individual financial context.

2. What key personal factors should I consider when using the Social Security Quick Calculator to determine my ideal application age?

To get the most accurate and useful results from the Social Security Quick Calculator for determining your ideal application age, you should carefully consider:

Your Birth Year: This is crucial for determining your Full Retirement Age (FRA).

Your Life Expectancy: A realistic estimate of how long you expect to live significantly impacts the total cumulative benefits you might receive over your lifetime.

Your Investment Return per Year: If you have other savings, the calculator can show how delaying Social Security might allow those investments to grow further, influencing your overall retirement income.

Cost of Living Adjustment (COLA) per Year: Understanding how inflation might affect the purchasing power of your future benefits is essential for long-term planning, and the calculator incorporates this.

3. Can the Social Security Quick Calculator help me compare the financial impact of taking benefits early versus delaying them?

Yes, absolutely! One of the core functionalities of the Social Security Quick Calculator is to enable you to compare the financial difference between two chosen Social Security retirement benefit application ages.

You can input estimated monthly payments for Social Security at different claiming ages (which you can typically find from the official SSA website), along with your personal investment return and COLA.

This allows the calculator to project the cumulative benefits for each scenario, helping you understand the trade-offs between receiving reduced benefits for a longer period (claiming early) or higher benefits for a shorter period (delaying).

4. Is the Social Security Quick Calculator the only tool I should use for my retirement planning, or should I consult other resources?

While the Social Security Quick Calculator is an excellent tool for strategizing your Social Security claiming age, it should be part of a broader retirement planning approach.

Social Security is intended to replace only about 40% of an average worker’s pre-retirement income, so it’s advisable to have other income sources like 401(k)s, IRAs, or pensions.

For comprehensive planning, you should also consider creating a “my Social Security” account on the official SSA website for personalized benefit estimates based on your actual earnings record, and potentially consult with a qualified financial advisor who can help integrate your Social Security strategy with your overall financial picture, including taxes, investments, and estate planning.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News

Table of Contents

Social Security Quick Calculator

Benefit estimates depend on your date of birth and on your earnings history. For security, the “Quick Calculator” does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough.

Although the “Quick Calculator” makes an initial assumption about your past earnings, you will have the opportunity to change the assumed earnings (click on “See the earnings we used” after you complete and submit the form below).

If you have any questions or comments about the Quick Calculator, please visit our Contact Social Security page for ways to contact us. Remember to use “Quick Calculator” as the subject so we know which calculator your question or comment refers to.

Social Security Calculator – Ideal Application Age

The U.S. Social Security website provides calculators for various purposes. While they are all useful, there currently isn’t a way to help determine the ideal (financially speaking) age at which a person between the ages of 62-70 should apply for their Social Security retirement benefits. This tool is designed specifically for this purpose. Please note that this calculator is intended for U.S. Social Security purposes only.

Determine the ideal application age

Use the following calculation to determine the ideal age to apply for Social Security retirement benefits based on age, life expectancy, and average investment performance.

Compare two application ages

Use the following calculation to compare the financial difference between two Social Security retirement benefit application ages. The U.S. Social Security website provides estimated benefit payment amounts of different claim ages.

Related