Summary : Illinois is making headlines by returning $45 million in unclaimed stimulus payments and forgotten funds to nearly 600,000 residents this summer of 2025. This initiative leverages the state’s “Enhanced Money Match” program, an automated system that identifies eligible recipients through unclaimed property data, requiring no application or paperwork from the residents themselves.

Highlights

- Illinois is distributing $45 million in unclaimed funds, including potential unclaimed stimulus payments during the summer of 2025.

- Approximately 600,000 Illinois residents will receive surprise checks without any application process.

- The funds originate from inactive bank accounts, uncashed refunds, insurance policies, and other forgotten assets managed by the state.

- Recipients will be notified by mail, and eligibility can be verified through the I-Cash public database.

Illinois’ $45 Million Windfall: How to Claim Your Unclaimed Stimulus Payments During Summer of 2025

This summer of 2025, Illinois is making financial news by proactively returning a staggering $45 million in unclaimed funds to nearly 600,000 of its residents. This significant initiative, powered by the state’s “Enhanced Money Match” program, is a beacon of hope for many who might unknowingly be sitting on forgotten money,

including potential unclaimed stimulus payments during the summer of 2025. Unlike traditional claims processes that often involve complex paperwork, this program is designed for simplicity, automatically identifying eligible individuals and sending them checks directly.

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

The Source of the Surprise: Where Does This Money Come From?

Many residents might wonder about the origin of these unexpected checks. The $45 million being distributed isn’t newly allocated stimulus money from federal programs. Instead, it stems from a vast pool of unclaimed property that the state of Illinois has accumulated over the years. This includes:

- Inactive bank accounts: Savings or checking accounts that have seen no activity for an extended period.

- Uncashed refunds and checks: From utility deposits, customer overpayments, payroll, or other sources.

- Unclaimed insurance policies: Benefits that were never claimed by beneficiaries.

- Forgotten dividends and other assets: Securities, mutual funds, or other financial holdings where contact with the owner was lost.

Under the Illinois Unclaimed Property Act, when companies and financial institutions lose contact with the rightful owners of these assets for a certain “dormancy period” (typically three to five years), they are legally required to turn these funds over to the Illinois State Treasurer’s Office.

The state then acts as the custodian of this forgotten money, with a legal obligation to reunite it with its original owners or their heirs, no matter how long it takes. This program, which began in 2018, has already successfully returned over $130 million to more than 870,000 residents, showcasing its effectiveness.

The Enhanced Money Match Program: A Seamless Return

The “Enhanced Money Match” program is the backbone of this seamless distribution. It utilizes sophisticated data matching technology to cross-reference the state’s unclaimed property database with information from other state agencies. This allows the Treasurer’s Office to identify and verify eligible recipients without them needing to file a claim or complete any forms.

The program specifically targets “simple claims,” primarily cash owed to a single individual. More complex claims, such as those involving multiple parties, stocks, or safe deposit box contents, still require a traditional claim process through the I-Cash database.

For the vast majority of the 600,000 residents, the checks will be for $50 or less. However, some individuals with multiple claims or larger forgotten assets could receive significantly more. The beauty of this system is its passive nature for the recipient – the state does the heavy lifting, ensuring that what’s rightfully yours finds its way back to you.

How to Know if You’re Eligible for Unclaimed Stimulus Payments During the Summer of 2025 (and Other Funds)

The state of Illinois has taken proactive steps to notify potential recipients. In late June 2025, letters were dispatched to individuals identified as eligible to receive these unclaimed stimulus payments during the summer of 2025 and other forgotten funds. These letters serve as a heads-up, preparing recipients to look out for their surprise check in the mail.

If you didn’t receive a letter but suspect you might have unclaimed funds, including potential unclaimed stimulus payments during the summer of 2025, there’s a simple way to verify your eligibility:

- Check the I-Cash Public Database: The official website for the Illinois State Treasurer’s Unclaimed Property Division is

icash.illinoistreasurer.gov. This publicly accessible database allows you to search for unclaimed property by entering your name or business name. You can also narrow your search by city or zip code for more precise results.

The I-Cash database is a powerful tool, holding records of over $5 billion in unclaimed property managed by the state. It’s recommended that Illinois residents check this database at least twice a year, as new unclaimed properties are continually added.

What to Do When Your Check Arrives (or if You Find Funds Online)

If you are one of the fortunate nearly 600,000 residents to receive a letter, or if your search on I-Cash yields a positive result, here’s what you should do:

- Check Your Mail Diligently: Keep an eye out for an envelope from the state of Illinois. This is not a scam; it’s your money being returned to you.

- Open and Cash the Check Without Delay: Many checks have an expiration date, so it’s crucial to deposit or cash your check as soon as possible to avoid any complications. Your own bank is usually the best option for cashing, but many large retailers also offer check-cashing services.

- If You Didn’t Receive a Letter, Check I-Cash: As mentioned, head to

icash.illinoistreasurer.govand perform a thorough search using your full name, any maiden names, or names of family members who might have had accounts. - Be Wary of Scams: While the state’s mailing is legitimate, always be cautious of unofficial communications asking for personal information or payment to release funds. The Illinois State Treasurer’s Office will never ask for money to return your unclaimed property. If in doubt, contact their official Unclaimed Property team directly via the contact information on their official website.

The Bigger Picture: Protecting Consumer Funds

The Illinois Unclaimed Property program is a vital consumer protection initiative. It ensures that money and assets aren’t simply absorbed by corporations or the state but are held in trust until they can be returned to their rightful owners.

This proactive approach by the Illinois State Treasurer’s Office, especially with the “Enhanced Money Match” program, significantly simplifies the process for thousands of citizens. It highlights the state’s commitment to financial accountability and its legal obligation to safeguard and return forgotten funds. This summer’s distribution of unclaimed stimulus payments during the summer of 2025 and other forgotten monies is a testament to this ongoing effort.

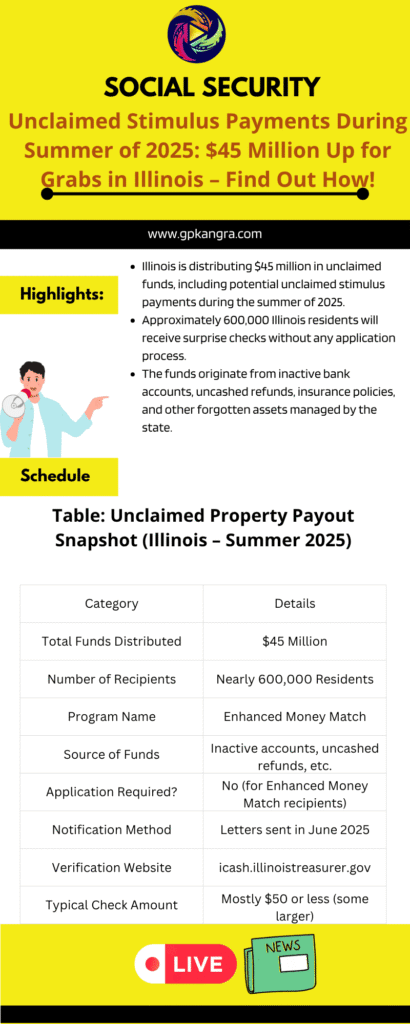

Table: Unclaimed Property Payout Snapshot (Illinois – Summer 2025)

| Category | Details |

| Total Funds Distributed | $45 Million |

| Number of Recipients | Nearly 600,000 Residents |

| Program Name | Enhanced Money Match |

| Source of Funds | Inactive accounts, uncashed refunds, etc. |

| Application Required? | No (for Enhanced Money Match recipients) |

| Notification Method | Letters sent in June 2025 |

| Verification Website | icash.illinoistreasurer.gov |

| Typical Check Amount | Mostly $50 or less (some larger) |

FAQs about Unclaimed Stimulus Payments During the Summer of 2025

Q1: What are unclaimed stimulus payments during the summer of 2025?

A1: In the context of Illinois, “unclaimed stimulus payments during the summer of 2025” refers to funds being distributed by the state from its pool of unclaimed property. While not new federal stimulus checks, these can include forgotten refunds or other money that residents were owed, some of which may have originated from earlier stimulus-related credits or forgotten financial assets. The state is proactively returning these monies.

Q2: Do I need to apply to receive these unclaimed stimulus payments during the summer of 2025 from Illinois?

A2: For the majority of the 600,000 residents receiving funds through the “Enhanced Money Match” program, no application or paperwork is required. The state automatically identifies eligible recipients and sends out checks. However, if your claim is more complex or you haven’t received a letter, you might need to initiate a claim through the I-Cash public database.

Q3: How can I check if I am eligible for unclaimed stimulus payments during the summer of 2025 or other forgotten funds?

A3: The state sent notification letters in late June 2025. If you didn’t receive a letter, you can still check your eligibility by visiting the official I-Cash public database at icash.illinoistreasurer.gov and searching for your name.

Q4: What types of “unclaimed property” does the state of Illinois return, beyond potential unclaimed stimulus payments during the summer of 2025?

A4: The state holds a wide variety of unclaimed property, including funds from inactive bank accounts, uncashed payroll checks, insurance policy payouts, forgotten utility deposits, unredeemed gift certificates (in some cases), stock dividends, and even the contents of safe deposit boxes.

Q5: Is there a deadline to claim these unclaimed stimulus payments during the summer of 2025 or other funds?

A5: While the state holds unclaimed property indefinitely, many checks issued through the “Enhanced Money Match” program will have an expiration date. It’s always best to cash or deposit any checks you receive from the state promptly. For funds found via the I-Cash database, there isn’t a strict deadline, but it’s advisable to initiate your claim as soon as possible.

Also read :

- Concrete Mix Design calculator as per IS 10262 : 2019

- ITR Filing Last Date 2025: New Deadlines Announced!

- AP EAMCET Seat Allotment 2025: Your College Awaits!

- UGC NET CUTOFF MARKS 2025 : SUBJECT / CATEGORY WISE CUTOFF MARKS

- Age 62 vs. 70: The Social Security Quick Calculator Reveals Your Perfect Retirement Sweet Spot!

Disclaimer : We gather our information from official websites and aim for accuracy and timeliness. However, some details may need further clarification or updates. Please contact us via our Contact Page with any questions or feedback, as your input helps us maintain accuracy. For the latest information, always refer to official sources.

Thank you for your understanding.

Team GPK News